Legal and Consultant Fees: Documentation Required to Avoid Disallowance

Your company incurred $145,000 in legal fees defending against an employment discrimination claim and $78,000 in consultant fees for “business advisory services”—both charged to indirect pools allocating across government contracts. During your incurred cost audit, DCAA questioned the entire $223,000, citing inadequate documentation supporting business purpose, lack of evidence demonstrating services were necessary and reasonable, and insufficient detail proving costs didn’t represent unallowable activities like patent prosecution, lobbying, or other specifically prohibited legal matters. Here’s what contractors miss about professional service fees: simply having invoices from reputable law firms or consulting companies doesn’t establish cost allowability—you need comprehensive documentation demonstrating what services were provided, why they were necessary for business operations, how costs were reasonable compared to services received, and that work didn’t involve unallowable activities that FAR specifically prohibits charging to government contracts regardless of business justification. Understanding how to document, justify, and defend legal and consultant fees isn’t about restricting professional service usage—it’s about maintaining contemporaneous records proving services provided legitimate business value, costs represented prudent expenditures a reasonable businessperson would incur, and work performed didn’t cross into unallowable categories that detailed documentation would reveal and prevent from government contract charging.

The Legal Framework Governing Professional Service Fee Allowability

Federal cost principles establish specific allowability criteria for legal and consultant fees ensuring government contracts don’t subsidize unnecessary services or prohibited activities. FAR 31.205-33 governs professional and consultant service costs, establishing that fees are allowable when services are necessary, costs are reasonable for services rendered, and specific documentation requirements are satisfied including written agreements, invoices showing services performed, and evidence supporting cost reasonableness. This provision makes documentation a compliance requirement rather than administrative preference—inadequate documentation renders otherwise allowable costs unallowable regardless of actual business necessity or service quality.

The reasonableness standard under FAR 31.201-3 requires costs to reflect amounts a prudent businessperson would incur under comparable circumstances, considering factors including market prices for similar services, whether services are necessary for business operations, and whether contractor exercised reasonable care and due diligence in selecting service providers and negotiating fees. Understanding DCAA compliance requirements means recognizing that professional service costs face heightened scrutiny because high hourly rates, subjective value determinations, and relationship-based selection create risks of unreasonable costs that inadequate documentation cannot defend against auditor questioning.

The specific unallowable cost categories under FAR 31.205 identify numerous legal and consultant activities that are unallowable regardless of documentation quality including: costs of patent prosecution (FAR 31.205-30), entertainment costs (FAR 31.205-14), lobbying costs (FAR 31.205-22), organizational costs (FAR 31.205-27), litigation costs in certain circumstances (FAR 31.205-47), and other specifically identified activities. Professional service documentation must demonstrate that work performed doesn’t fall into these prohibited categories, with detailed scope descriptions and work product evidence supporting allowable classification rather than generic descriptions potentially masking unallowable activities.

The critical consideration involves FAR 31.205-47, governing costs of legal and other proceedings, which establishes complex allowability determinations based on proceeding types, outcomes, and whether contractor had reasonable grounds for litigation positions. Legal costs defending against claims arising from contractor misconduct are unallowable, while costs defending against frivolous claims might be allowable with proper documentation. This complexity means legal fee allowability often requires judgment and supporting analysis that simple invoice retention cannot provide.

What Contractors Must Understand About Professional Service Documentation Challenges

Here’s what contractors miss about legal and consultant fees: generic monthly invoices showing hours worked and rates charged provide insufficient documentation for DCAA verification regardless of whether total costs appear reasonable. DCAA compliance explained emphasizes that allowability requires proving what specific services were performed, why those services were necessary, that costs were reasonable for work done, and that activities didn’t involve unallowable matters—none of which generic billing summaries demonstrate without supplementary documentation explaining scope, purpose, and business justification.

The scope description inadequacy problem emerges when engagement letters or invoices contain vague descriptions like “legal services,” “business consulting,” or “advisory services” without explaining specific work performed, deliverables produced, or business problems addressed. This is where audits go sideways—your legal invoice shows “10 hours—contract review at $400/hour = $4,000” but doesn’t identify which contracts were reviewed, what issues required legal analysis, why internal review was insufficient requiring external counsel, or what work product resulted from review. Without this detail, DCAA cannot verify that services provided legitimate business value rather than representing unnecessary expenditures, personal matters, or unallowable activities that generic descriptions might conceal.

The business necessity justification gap surfaces when contractors cannot explain why professional services were required rather than handled through internal resources or less expensive alternatives. DCAA timekeeping requirements extend conceptually to professional service documentation requiring evidence that service needs exceeded internal capabilities, that selected providers possessed specialized expertise justifying external engagement, and that service timing addressed actual business needs rather than discretionary projects lacking genuine operational necessity. Your $78,000 consultant engagement might provide valuable strategic insights, but without documentation explaining why internal management couldn’t perform similar analysis or why timing was operationally critical, costs appear as discretionary rather than necessary expenditures.

The fee reasonableness support challenge appears when contractors lack evidence demonstrating fees charged represent fair market value for services received. Simple rate disclosure doesn’t establish reasonableness—you need comparative pricing from alternative providers, industry benchmarking showing rates align with market norms, or analysis demonstrating that while rates are high, total costs reflect efficient service delivery minimizing hours rather than excessive billing at inflated rates. When your attorney charges $500/hour but completes work in 20 hours that others quote 40 hours at $300/hour, higher rate might represent better value requiring documentation supporting efficiency rather than just rate comparison.

The unallowable cost risk emerges when legal or consultant services involve activities that FAR specifically prohibits but generic documentation doesn’t clearly exclude. Your legal fees might include allowable contract review, unallowable patent work, and allowable employment matters combined in monthly invoices without clear segregation enabling proper cost classification. When invoices lack sufficient detail distinguishing between allowable and unallowable activities, DCAA treats entire amounts as questionable requiring detailed reconstruction that might be impossible months or years after services occurred.

The outcome dependency consideration affects litigation cost allowability based on case results, contractor culpability, and whether proceedings allege violations of law or regulation. Defending against employee discrimination claims might produce allowable costs if contractor had reasonable grounds for its employment decisions and proper documentation supported its positions, or unallowable costs if investigation reveals contractor misconduct or discriminatory practices. This outcome-based allowability means contemporaneous documentation during proceedings becomes critical to supporting eventual allowability determinations that invoice retention alone cannot establish.

The engagement documentation void manifests when contractors lack written agreements establishing scope, deliverables, billing terms, and service parameters that professional engagements should define before work begins. Verbal agreements or email exchanges provide weaker documentation than formal engagement letters or contracts specifying what services provider will deliver, how costs will be determined, what business objectives engagement addresses, and how success will be measured. Without written agreements, documenting scope and justifying costs becomes retrospective exercise attempting to reconstruct contemporaneous decisions rather than referring to documented plans established before expenditures occurred.

Five Essential Steps for Defensible Legal and Consultant Fee Documentation

Step 1: Establish Comprehensive Written Engagement Agreements Before Services Begin

Develop formal engagement letters or professional service agreements for all legal and consultant relationships establishing detailed scope descriptions, specific deliverables expected, fee structures and billing rates, estimated total costs or not-to-exceed amounts, service timelines and milestones, and business objectives engagement will address. Written agreements provide documentation foundation supporting subsequent allowability determinations by demonstrating services were planned deliberately rather than engaged casually, that scope was defined rather than open-ended, and that contractor exercised reasonable diligence before committing to expenditures.

Require scope statements describing specific work to be performed with sufficient detail enabling verification that services involve allowable activities rather than potentially prohibited matters. Generic scope like “provide legal advice” provides inadequate documentation compared to detailed descriptions: “Review proposed teaming agreement for Contract XYZ, analyze liability allocation provisions, identify compliance risks under FAR and DFARS requirements, and provide recommendations for negotiated revisions.” Detailed scopes enable both management understanding of what they’re buying and audit verification supporting cost allowability through demonstrated business purpose.

Include business justification language in agreements explaining why external services are necessary, what internal capability gaps require outside expertise, and how engagement timing addresses specific business needs or opportunities. This justification documentation demonstrates necessity rather than convenience, supporting reasonableness determinations when auditors question whether services represented prudent expenditures versus discretionary spending lacking genuine operational requirement.

Step 2: Require Detailed Invoices with Sufficient Task and Time Description

Establish invoice requirements in engagement agreements specifying minimum detail levels including: date services performed, brief description of specific tasks completed each day, hours or time units for each task, personnel performing work with their rates, expenses incurred with receipts or substantiation, and progress toward deliverables or milestones. Detailed invoices provide transparency about services received supporting both payment approval and subsequent audit verification, while generic summaries create documentation gaps requiring extensive supplementary explanation during audits.

Implement invoice review procedures requiring project managers or responsible executives to verify invoice accuracy before payment approval, confirming services described were actually performed, hours charged appear reasonable for work completed, and billing complies with agreed fee structures. Management review documents that contractor exercised oversight rather than paying invoices blindly, demonstrating cost consciousness and fiduciary responsibility that auditors expect from prudent businesspersons.

Request work product documentation accompanying invoices when services produce deliverables including legal memoranda, consultant reports, analysis documents, or recommendations. Work product provides evidence services were actually performed and delivered value rather than just consuming budget, strengthening allowability support through tangible results demonstrating business benefit received for costs incurred.

Step 3: Maintain Contemporaneous Records Documenting Business Purpose and Necessity

Create detailed memoranda at engagement initiation explaining business circumstances requiring professional services, what problems or opportunities engagement addresses, why internal resources cannot adequately handle needs, how service provider was selected, and what benefits contractor expects from engagement. These contemporaneous records document decision-making rationale when details remain fresh, preventing the reconstruction challenges that emerge during audits occurring months or years after engagement completion when participants have departed or memories have faded.

Develop project files for significant engagements containing: engagement agreements, invoices with payment approvals, work product or deliverables received, correspondence with service providers, scope change documentation when modifications occur, and completion summaries documenting results achieved and value delivered. Organized project files enable efficient audit support by consolidating documentation demonstrating services were properly planned, delivered as agreed, and provided value justifying costs incurred.

Implement periodic engagement reviews evaluating whether ongoing services continue providing value justifying costs, whether scope modifications are needed addressing changed circumstances, or whether engagements should be concluded when objectives are achieved or circumstances change eliminating needs. These reviews document active management oversight preventing the drift where professional service relationships continue through inertia rather than ongoing necessity, demonstrating cost consciousness that auditors recognize as prudent business practice.

Step 4: Segregate and Document Unallowable Cost Components

Establish procedures identifying when legal or consultant services involve unallowable activities requiring cost segregation including patent prosecution, organizational costs, lobbying, entertainment, or other specifically prohibited matters. Require service providers to segregate potentially unallowable work on invoices, create separate billing codes for unallowable activities, or provide sufficient detail enabling contractor to identify and reclassify unallowable costs before general ledger posting rather than discovering mixed allowable/unallowable costs during year-end closing or audits.

Deploy systematic unallowable cost identification during invoice review examining descriptions for indicators of prohibited activities, questioning ambiguous charges potentially involving unallowable work, and coding identified unallowable amounts to dedicated accounts excluding costs from indirect pools before rate calculations. Proactive identification prevents the questioned costs resulting when auditors discover unallowable activities concealed within professional service charges that inadequate review failed to detect and segregate.

Document unallowable cost determinations with written analysis explaining why specific charges represent unallowable activities, citing applicable FAR provisions supporting unallowable classification, and showing amounts excluded from indirect pools and contract charges. This documentation demonstrates compliance diligence while supporting audit defense when DCAA examines unallowable cost identification procedures and verifies proper exclusion from government contract billing.

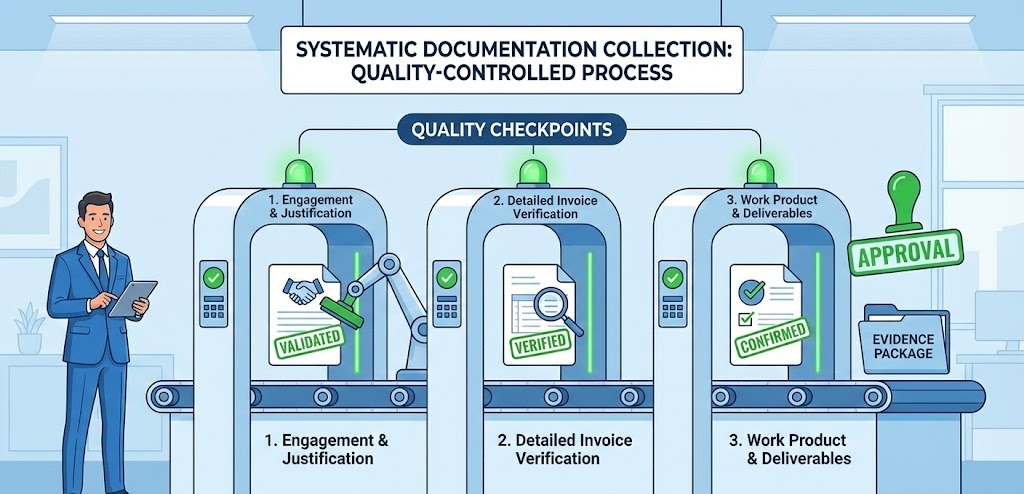

Step 5: Prepare Comprehensive Audit Support Documentation Packages

Develop organized documentation packages for significant professional service expenditures consolidating: engagement agreements establishing scope and terms, business justification memoranda explaining necessity, invoices with detailed task descriptions, work product demonstrating deliverables received, cost reasonableness analysis supporting fee appropriateness, unallowable cost identification and exclusion documentation, and completion summaries documenting results and value delivered. Comprehensive packages enable efficient audit response while demonstrating systematic documentation supporting cost allowability through multiple complementary evidence types.

Create summary schedules for annual professional service costs showing: provider names and descriptions, total costs by provider, engagement purposes and business justifications, allowable versus unallowable cost segregations, and cross-references to detailed supporting documentation. Summary schedules provide auditors efficient overview enabling targeted detailed examination rather than requiring exhaustive review of all professional service documentation, demonstrating organizational transparency about significant cost categories.

Implement pre-submission review procedures before incurred cost proposal preparation examining professional service documentation for gaps requiring correction, ambiguous descriptions needing clarification, missing agreements requiring reconstruction from available evidence, or unallowable costs needing identification and exclusion. Pre-submission review catches documentation deficiencies enabling proactive correction before DCAA examination rather than scrambling during audits to produce missing records or reconstruct contemporaneous decisions from inadequate documentation.

The Investment in Professional Service Documentation Excellence

Implementing comprehensive professional service documentation procedures costs between $8,000 and $25,000 for small to mid-sized contractors including template development, procedure documentation, training delivery, and file organization. Ongoing documentation maintenance costs typically run $3,000 to $10,000 annually for engagement management, invoice review, and file maintenance. These investments prevent the substantial questioned costs that inadequate documentation creates when DCAA cannot verify allowability through insufficient supporting records.

Let me show you the value: contractors with excellent professional service documentation maintain cost allowability through comprehensive evidence supporting necessity, reasonableness, and proper cost classification. They experience efficient audits when organized documentation enables rapid verification without extensive additional information requests. They avoid the massive questioned costs resulting when inadequate documentation prevents proving allowability of otherwise legitimate professional service expenditures.

Contractors with poor professional service documentation face wholesale disallowance of legal and consultant fees when generic invoices and missing agreements prevent verifying cost allowability, experience extended audit processes while scrambling to reconstruct missing documentation or provide explanatory memoranda addressing inadequate records, and suffer business relationship damage when service providers must be contacted years after engagements seeking retrospective documentation supporting audit defense.

Understanding Professional Service Cost Requirements Across Contract Types

Professional service cost documentation requirements apply uniformly when costs charge to cost-reimbursement contracts or allocate through indirect rates affecting any government work. FAR cost principles governing legal and consultant fees apply consistently across Department of Defense, NASA, Department of Energy, and civilian agency contracts, meaning documentation standards remain uniform regardless of customer agency.

The heightened scrutiny professional service costs receive stems from cost category characteristics including: subjective value determinations complicating reasonableness assessment, relationship-based selection potentially favoring expensive providers over competitive alternatives, open-ended scope enabling cost escalation beyond initial expectations, and overlap risks with unallowable activities requiring careful segregation. These characteristics make documentation critical to demonstrating prudent business judgment rather than unreasonable expenditures or unallowable cost charging.

Your Path to Professional Service Documentation Success

The professional service cost landscape rewards contractors who invest in comprehensive engagement documentation, detailed invoice requirements, and systematic cost justification rather than treating legal and consultant relationships as routine vendor arrangements requiring minimal documentation beyond invoice retention. DCAA evaluates professional service costs through detailed documentation review examining scope definition, business necessity justification, fee reasonableness support, and unallowable cost segregation.

For contractors seeking professional service compliance, Hour Timesheet provides labor tracking supporting documentation of internal time spent managing external professional service relationships, reviewing deliverables, and implementing recommendations—demonstrating active engagement rather than passive service consumption. Our systems provide time-based evidence supporting cost accounting for professional service oversight activities.

Your professional service relationships deserve documentation demonstrating services provide legitimate business value at reasonable costs supporting allowable activities. Implement systematic procedures ensuring comprehensive records support cost allowability through multiple evidence types proving necessity, reasonableness, and proper cost classification.