For government contractors operating under federal contracts, DCAA compliance isn’t just a regulatory requirement—it’s essential for business survival. The choice between time tracking solutions can make the difference between passing audits with confidence and facing costly compliance failures. While both Hour Timesheet and QuickBooks Time offer time tracking capabilities, their approaches to DCAA compliance couldn’t be more different.

Hour Timesheet provides a purpose-built solution specifically designed from the ground up for DCAA requirements. Every feature, workflow, and reporting function has been crafted with government contractor compliance in mind. In contrast, QuickBooks Time operates as a general business time tracking tool that requires significant third-party integrations, extensive customization, and ongoing maintenance to achieve even basic DCAA compliance.

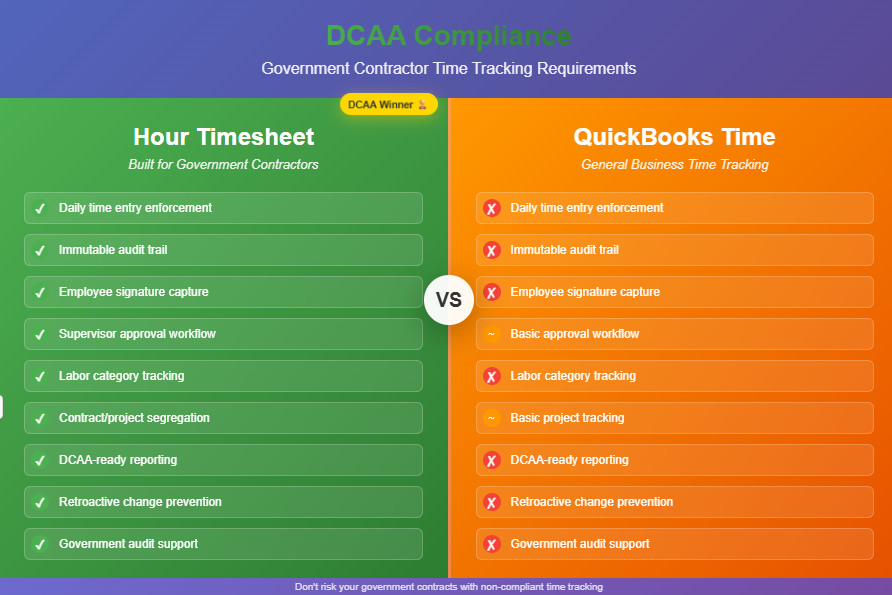

Key DCAA Requirements Comparison

The Defense Contract Audit Agency has strict requirements for daily time entry that form the foundation of compliant timekeeping. These requirements demand that all employees working on government contracts record their time daily, with no advance entries or retroactive time logging allowed beyond the same business day.

✅ Daily Time Entry Requirements

Hour Timesheet:

Built-in daily time tracking reminders and alerts

Prevents time entry in advance or days after the fact

Automated notifications to ensure daily compliance

Real-time validation of daily time entry

QuickBooks Time:

Basic time tracking capabilities

Requires manual processes to enforce daily entry

No built-in DCAA-specific compliance alerts

Relies on manager oversight for daily entry compliance

✅ Audit Trail & Change Tracking

When DCAA auditors review your timekeeping system, they’re looking for comprehensive audit trails that document every change, modification, and approval in your time tracking process. The ability to demonstrate who changed what, when they changed it, and why the change was necessary can determine whether you pass or fail an audit.

Hour Timesheet:

Detailed audit trails for all time entries and modifications

Automatic reason code prompts for time changes

Complete history of all edits with timestamps

Built-for-purpose audit reporting

QuickBooks Time:

Basic edit history available

Limited audit trail functionality

Requires third-party solutions for comprehensive audit trails

Manual processes needed for change documentation

✅ Supervisor Approval Process

DCAA compliance requires robust supervisor approval processes that ensure all time entries are reviewed and approved by authorized personnel before being used for billing purposes. The complexity of government contracts often demands multiple levels of approval, with different supervisors responsible for different aspects of project oversight.

Hour Timesheet:

Multi-level supervisor approval workflows

Manager approval tracking and reporting

Automated approval notifications and reminders

Complete approval audit trail

QuickBooks Time:

Basic approval functionality

Limited workflow customization

Requires additional configuration for DCAA compliance

Less robust approval reporting

✅ Cost Allocation & Job Costing

Accurate cost allocation lies at the heart of DCAA compliance, as government contracts require precise tracking of labor hours to specific projects, tasks, and contract line items. The ability to demonstrate that billed hours directly correspond to work performed on specific contracts is fundamental to maintaining contractor eligibility.

Hour Timesheet:

Direct integration with authorized charge codes

Automated cost allocation to projects/contracts

DCAA-compliant labor distribution

Real-time project cost tracking

QuickBooks Time:

Basic project time tracking

Requires QuickBooks Online/Desktop integration

Manual setup required for proper cost allocation

Limited DCAA-specific cost reporting

Implementation & Setup

The speed at which you can achieve DCAA compliance directly impacts your ability to bid on and perform government contracts. Extended implementation periods can delay contract start dates and increase overall project costs.

Hour Timesheet

Setup Time: Minimal – designed for DCAA out-of-the-box

Configuration: Pre-configured DCAA compliance features

Training: Streamlined for government contractors

Maintenance: Automatic updates maintain compliance

QuickBooks Time

Setup Time: Extensive – requires significant customization

Configuration: Manual DCAA compliance setup needed

Training: General time tracking + compliance training required

Maintenance: Ongoing compliance monitoring required

Reporting & Documentation

DCAA audits require extensive documentation and reporting that demonstrates compliance with federal acquisition regulations. The quality and accessibility of this documentation often determines audit outcomes.

Hour Timesheet

Advantages:

DCAA-specific reporting templates

Automated compliance reports

Audit-ready documentation

Integration with payroll for labor distribution

QuickBooks Time

Limitations:

Generic reporting requires customization

Additional tools needed for DCAA reporting

Manual report generation for audits

Limited compliance-specific documentation

Integration Capabilities

Modern government contractors require time tracking systems that integrate seamlessly with their existing accounting, payroll, and project management tools. The quality of these integrations can significantly impact operational efficiency and compliance accuracy.

Hour Timesheet

Direct QuickBooks Desktop & Online integration

Payroll system connectivity

Mobile app with offline capability

API for custom integrations

QuickBooks Time

Native QuickBooks integration

Limited third-party DCAA compliance tools

Requires additional software for full compliance

May need GovBooks or similar add-ons

Pricing Considerations

Understanding the true cost of DCAA compliance requires looking beyond initial subscription fees to include implementation, training, maintenance, and ongoing compliance monitoring expenses.

Hour Timesheet

All DCAA compliance features included

No additional compliance modules required

Transparent pricing for government contractors

Cost-effective for compliance requirements

QuickBooks Time

Base subscription + additional compliance tools

Third-party integration costs

Potential consulting fees for setup

Hidden costs for full DCAA compliance

Making the Right Choice

Government contractors requiring immediate DCAA compliance will find Hour Timesheet’s purpose-built approach significantly more efficient than attempting to adapt a general business tool. Organizations that need automated compliance monitoring, minimal implementation time, and dedicated government contracting support will benefit from

Hour Timesheet’s specialized focus

Government contractor requiring immediate DCAA compliance

Need purpose-built compliance features

Want minimal implementation time

Require dedicated government contracting support

Need automated compliance monitoring

Seeking lower total cost of ownership for compliance

QuickBooks Time limitations:

Not DCAA compliant out-of-the-box

Requires significant additional investment

Complex setup and maintenance

Generic solution not optimized for government contractors

Key Take-Aways

- “Built for DCAA, not adapted for it” – Hour Timesheet was designed specifically for government contractor compliance requirements

- “Compliance confidence from day one” – Immediate DCAA compliance without complex setup or third-party add-ons

- “Lower total cost of compliance” – Avoid hidden costs of making QuickBooks Time DCAA compliant

- “Audit-ready automatically” – Built-in audit trails, reporting, and documentation that auditors expect