Your company migrated to cloud-based accounting to reduce IT infrastructure costs, enable remote work flexibility, and access your financial data from anywhere. Then DCAA auditors requested system access for their incurred cost audit and raised questions about data security controls, user access management, and whether your cloud provider’s terms of service actually permit government auditor access to records supporting federal contract costs. Here’s what contractors miss about cloud accounting and DCAA compliance: cloud platforms provide excellent operational capabilities and cost efficiency, but government contract requirements under FAR 52.215-2 mandate specific audit access rights, data security controls, and record preservation capabilities that standard commercial cloud subscriptions don’t automatically address. Understanding how to configure cloud systems for DCAA compliance—and what to negotiate with cloud providers—protects both your technology investment and your contract portfolio while leveraging modern infrastructure.

The Legal Framework Cloud Systems Must Satisfy

DCAA audit access requirements stem from Federal Acquisition Regulation clauses embedded in solicitations and contracts granting government auditors specific rights to examine contractor records. FAR 52.215-2, the Audit and Records clause, requires contractors to maintain and make available records supporting costs charged to government contracts, with access rights extending until three years after final payment. This isn’t optional access contingent on contractor convenience—it’s a legal obligation creating contractor responsibility to provide timely, complete audit access regardless of record storage location or format.

FAR 31.201-2 establishes that allowable costs must be adequately documented, meaning your cloud-based records must provide the same audit trail depth, transaction detail, and supporting documentation as traditional on-premise systems. The regulation doesn’t distinguish between cloud and local storage—it mandates adequate records supporting cost determinations. Your cloud migration can’t reduce documentation quality or auditor access compared to previous systems.

The critical consideration for cloud contractors involves FAR 4.703, governing file retention requirements mandating contractors preserve records for specified periods including three years after final payment for most contracts. Cloud systems must ensure data retention through contract closeout periods regardless of subscription status, platform changes, or business relationship modifications with cloud providers. When your QuickBooks Online subscription expires, you still need records supporting closed government contracts—and “I don’t have access anymore” doesn’t satisfy FAR retention obligations.

What Contractors Must Understand About Cloud Compliance Challenges

Here’s what contractors miss about cloud-based accounting: commercial cloud platforms prioritize ease of use, mobility, and subscription revenue over government contractor compliance requirements that represent niche market needs. Your cloud provider optimizes for millions of small businesses needing basic accounting, not thousands of government contractors requiring DCAA audit accommodation. Standard terms of service rarely address auditor access rights, data preservation obligations, or security controls specific to federal contract cost accounting.

The audit access challenge creates immediate compliance concerns when DCAA requests system access for electronic audit procedures. Auditors increasingly use data analytics requiring direct system access rather than reviewing exported reports or printed documents. Your cloud provider might prohibit sharing login credentials with third parties (including government auditors), lack functionality for creating auditor-specific user accounts, or impose additional fees for audit access creating financial barriers to compliance. Understanding DCAA compliance requirements means ensuring your cloud platform supports auditor access before DCAA arrives requesting system entry.

Data security and segregation presents another cloud compliance complexity. Government contracts often require protecting controlled unclassified information, proprietary technical data, or cost and pricing information from unauthorized disclosure. Your cloud accounting system contains sensitive contract pricing, indirect rate calculations, and employee compensation data requiring protection. Multi-tenant cloud architectures where your data shares infrastructure with other subscribers create security considerations different from dedicated on-premise servers under your complete control.

The data export and portability challenge affects long-term compliance when you need historical records after changing cloud providers or when subscriptions lapse. DCAA compliance explained requires maintaining complete records for minimum three years after contract completion—potentially 5-7 years from original data entry depending on contract closeout timing. Your cloud system must enable exporting complete datasets including transaction details, supporting documentation, and audit trail histories in formats preserving usability for future audit access.

User access controls and audit trail capabilities separate compliant cloud systems from basic platforms serving commercial businesses. Government contract accounting demands detailed audit trails showing who entered transactions, when entries occurred, what modifications happened, and management approval workflows supporting cost accuracy. Generic cloud accounting providing simplified bookkeeping might lack the granular audit trail detail DCAA expects during compliance verification.

Five Essential Steps for Cloud Accounting Compliance

Step 1: Verify and Document DCAA Audit Access Provisions

Review your cloud platform’s terms of service and user agreements identifying provisions affecting government auditor access to your records. Contact your cloud provider confirming they permit creating temporary auditor user accounts, allow government personnel system access, and won’t impose excessive fees or delays when DCAA requests audit access. Document these access provisions in writing including screenshots of relevant terms, email confirmations from provider support, and any negotiated modifications addressing government audit requirements.

Request specific audit access features from your cloud provider including ability to create read-only user accounts for auditors, configure access periods matching audit timelines, and generate comprehensive audit logs showing all system activity during audit periods. Some cloud platforms offer government contractor-specific tiers or compliance packages addressing DCAA access needs—investigate whether your provider offers enhanced versions supporting compliance requirements.

Establish documented procedures for providing DCAA auditors with system access including user account creation processes, access credential delivery methods, and support contacts assisting auditors navigating your cloud platform. Test these procedures annually through mock audits confirming system access works as documented before real DCAA audits arrive.

Step 2: Implement Comprehensive Data Security and Access Controls

Configure your cloud accounting with role-based access controls limiting user permissions to minimum necessary for job functions. Deploy multi-factor authentication for all users adding security layers beyond simple passwords protecting sensitive contract cost data from unauthorized access. Enable detailed activity logging capturing all user actions including data access, transaction entry, report generation, and configuration changes supporting security verification.

Establish data classification procedures identifying information requiring enhanced protection including contract pricing, indirect rate calculations, employee compensation details, and proprietary technical data embedded in project descriptions or cost accounts. Implement additional security controls for classified data categories including encryption for data at rest and in transit, restricted user access, and monitoring for unusual access patterns suggesting potential security incidents.

Deploy regular security assessments including user access reviews confirming current permissions remain appropriate, activity log analysis identifying anomalous behavior, and vulnerability scanning ensuring your cloud platform maintains current security patches. Document these security procedures demonstrating systematic protection of government contract information satisfying reasonable business practice standards.

Step 3: Create Comprehensive Data Backup and Retention Systems

Implement automated backup procedures capturing complete accounting data including transaction details, supporting attachments, user information, and system configurations on at least weekly basis. Store backups separately from primary cloud platform—either through provider’s backup services or third-party backup solutions—ensuring data availability if primary platform experiences outages, service terminations, or data loss incidents.

Develop documented data retention policies establishing preservation periods for different record types based on FAR requirements, contract closeout timing, and applicable statute of limitations periods. Configure your cloud system’s retention settings preventing automatic deletion of historical data needed for regulatory compliance. Create procedures for archiving old data when approaching cloud storage limits without losing access required for audit or legal purposes.

Establish data portability procedures enabling complete dataset export in standard formats (CSV, PDF, database dumps) preserving full functionality and audit trail integrity. Test export procedures annually confirming your ability to retrieve complete historical records in usable formats without cloud provider assistance—eliminating dependency on continued platform access for compliance obligations.

Step 4: Build Integration Between Cloud Accounting and Specialized Compliance Systems

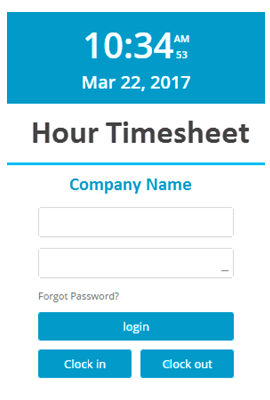

Recognize that general-purpose cloud accounting platforms excel at bookkeeping but often lack specific government contractor capabilities including DCAA-compliant timekeeping, job costing granularity, or unallowable cost segregation. Deploy specialized solutions like Hour Timesheet for compliant timekeeping integrating with your cloud accounting through APIs or data feeds ensuring labor cost accuracy while maintaining audit trail integrity.

Configure integration architecture ensuring data flows seamlessly between specialized compliance systems and cloud accounting without manual intervention or data transformation steps introducing errors. Implement reconciliation procedures comparing specialized system totals to cloud accounting accumulation verifying integration accuracy and identifying interface failures requiring immediate correction.

Establish change management procedures governing updates to either cloud accounting platforms or integrated compliance systems, testing changes in sandbox environments before production deployment ensuring updates don’t disrupt integration or introduce compliance gaps. Document all integration architecture including data flow diagrams, interface specifications, and testing procedures supporting audit verification.

Step 5: Develop Cloud Provider Relationship and Contingency Planning

Create formal communication channels with cloud provider support teams including dedicated contacts for compliance questions, service level agreements addressing audit support needs, and escalation procedures ensuring priority handling of government audit access requests. Document your provider relationship strength through service agreements, support responsiveness records, and provider compliance certifications demonstrating their understanding of government contractor requirements.

Develop contingency plans addressing potential cloud provider service disruptions, business failures, or relationship terminations ensuring continued access to historical records required for compliance. Maintain current data backups sufficient to reconstruct accounting records through alternative platforms if forced to migrate unexpectedly. Establish relationships with alternative cloud providers enabling rapid migration if current provider proves inadequate for government compliance needs.

Implement annual provider assessments evaluating whether your cloud platform continues meeting compliance requirements as your business grows, contract portfolio expands, or government regulations evolve. Be prepared to migrate to more capable platforms when business needs exceed current cloud system capabilities—vendor lock-in concerns shouldn’t prevent addressing compliance inadequacies.

The Investment in Cloud Compliance Configuration

Configuring cloud-based accounting for DCAA compliance costs between $5,000 and $25,000 for small to mid-sized contractors depending on platform selection, integration requirements, and security enhancement needs. This includes initial setup, user training, integration with specialized compliance tools, security configuration, and backup system implementation. Most costs represent one-time configuration rather than ongoing expenses, though annual backup storage and security monitoring may add $1,200 to $3,600 in recurring costs.

Let me show you the value: contractors using properly configured cloud accounting systems access financial data from anywhere enabling remote work and distributed operations, reduce IT infrastructure costs eliminating server maintenance and software updates, and scale systems efficiently as business grows without major platform replacements. Cloud platforms provide operational advantages justifying investment when properly configured for compliance.

Contractors with inadequate cloud configurations face audit delays while reconstructing records from incomplete exports, questioned costs when audit trail deficiencies prevent cost verification, and potential data loss if provider relationships terminate before completing required retention periods. These compliance failures offset any cost savings from cheap cloud subscriptions lacking adequate capabilities.

Understanding Cloud Compliance Across Federal Agencies

DCAA audit access requirements and FAR record retention obligations apply uniformly across all federal agencies and contract types. Your cloud accounting must satisfy identical compliance standards whether supporting Department of Defense contracts, NASA programs, Department of Energy agreements, or civilian agency work. The audit and records clause in FAR 52.215-2 creates consistent national requirements eliminating agency-specific variations in cloud system expectations.

Fixed-price and cost-reimbursement contracts impose identical record retention and audit access obligations despite different cost accounting requirements. Your cloud platform must serve all contract types in your portfolio through comprehensive record-keeping supporting cost verification regardless of contract pricing structure.

Your Path to Cloud Accounting Success

The cloud accounting landscape rewards contractors who invest in proper platform selection and configuration rather than choosing cheapest subscriptions without government compliance consideration. DCAA evaluates record adequacy and audit access capability, not technology sophistication—your cloud system must deliver compliance regardless of operational elegance or mobile app features.

For contractors seeking cloud-based compliance tools combining modern technology with government requirements, Hour Timesheet provides purpose-built solutions designed specifically for federal contractor needs. Our cloud platform delivers DCAA-compliant timekeeping with comprehensive audit trails, secure data storage, and auditor access capabilities while integrating with major cloud accounting platforms including QuickBooks Online, Xero, and NetSuite.

Your cloud migration strategy should leverage modern technology advantages while ensuring compliance capabilities protecting your contract portfolio. Choose platforms and providers understanding government contractor requirements, not just general small business accounting needs.

Additional Resources

Related Hour Timesheet Articles:

- DCAA Timekeeping Requirements

- DCAA Compliance Requirements for Contractors

- DCAA Compliance Explained

Official Regulatory References: