SBIR and STTR Phase II awards represent a critical transition point where your innovative research concept moves toward commercialization—and where your accounting systems must evolve to handle increasingly complex cost tracking requirements. What worked for your $250,000 Phase I feasibility study won’t satisfy the cost accounting demands of a $1.5 million Phase II development contract with multiple technical objectives, prototype fabrication, and commercial partnership activities. The accounting challenge isn’t just tracking more dollars—it’s distinguishing between allowable research costs, unallowable production costs, and commercial development expenses while proving every dollar charged to your SBIR/STTR contract complies with FAR 31.205-18 independent research and development cost principles. Here’s what Phase II contractors need to understand about research versus production cost accounting—and how to build systems supporting both innovation and compliance.

The Regulatory Framework Governing SBIR/STTR Cost Accounting

SBIR and STTR contracts operate under standard Federal Acquisition Regulation cost principles, but with specific considerations reflecting their research and development nature. FAR 35.017 establishes special procedures for SBIR/STTR contracts including simplified acquisition procedures and streamlined administration—but these simplified procedures don’t eliminate fundamental cost accounting obligations under FAR 31.201-2 requiring reasonable costs and FAR 31.201-4 requiring allocable costs supported by adequate records.

The critical regulation Phase II contractors must understand is FAR 31.205-18, governing independent research and development and bid and proposal costs. While SBIR/STTR work is contract-funded research rather than IR&D, this regulation establishes the framework for distinguishing research activities from production, manufacturing, and commercial development. The regulation specifically addresses cost allowability when research transitions toward production, creating the boundary contractors must navigate as Phase II work progresses from prototype development toward commercial products.

13 CFR 121.702 establishes size and eligibility standards for SBIR/STTR programs including the requirement that awardees perform a minimum percentage of work with their own employees rather than subcontractors. This creates cost accounting implications requiring contractors to track work performance by organizational entity, distinguish between prime contractor effort and subcontractor work, and maintain systems proving compliance with percentage-of-work requirements throughout contract performance.

What Phase II Contractors Must Navigate

Here’s what contractors miss about Phase II cost accounting: the contract scope intentionally blurs boundaries between pure research and early production activities as you develop prototypes, test manufacturing processes, and validate commercial viability. Your cost accounting system must maintain clear boundaries even when the technical work flows seamlessly from design to prototype fabrication to manufacturing process development. When your engineer spends morning hours finalizing product design (research cost) and afternoon hours setting up production tooling (unallowable production cost), your timekeeping system must capture that distinction with precision.

The transition from research to production creates the most complex cost accounting challenge in Phase II contracts. You’re funded to develop technology readiness and prove commercial feasibility—work that necessarily involves building prototypes and demonstrating manufacturing capability. But FAR 31.205-1 specifically prohibits charging production costs to government contracts. The boundary lies in intent and scope: building prototypes to prove your technical approach is allowable research; building production inventory for commercial sales is unallowable production cost even when using identical processes and materials.

Material cost accounting gets complicated when you’re purchasing components serving multiple purposes. That batch of specialized semiconductors might support Phase II prototype development (allowable), future production inventory (unallowable), and your separate commercial product line (unallowable to SBIR/STTR). Your purchasing and inventory systems must track material disposition from receipt through consumption, ensuring only materials actually incorporated into Phase II deliverables or consumed in Phase II testing get charged to your government contract.

Understanding DCAA compliance requirements for SBIR/STTR contractors means building systems that maintain research versus production boundaries throughout your technical development process while documenting the business rationale supporting cost classifications when activities serve both research and commercial purposes.

Five Essential Compliance Steps for Phase II Accounting

Step 1: Implement Activity-Based Cost Classification Systems

Build timekeeping systems capturing work activities with sufficient detail to support research versus production cost determinations. Generic labor categories like “engineering” or “fabrication” don’t provide adequate information for cost classification—you need activity codes distinguishing prototype development from production setup, research testing from manufacturing validation, and technical documentation from commercial marketing materials.

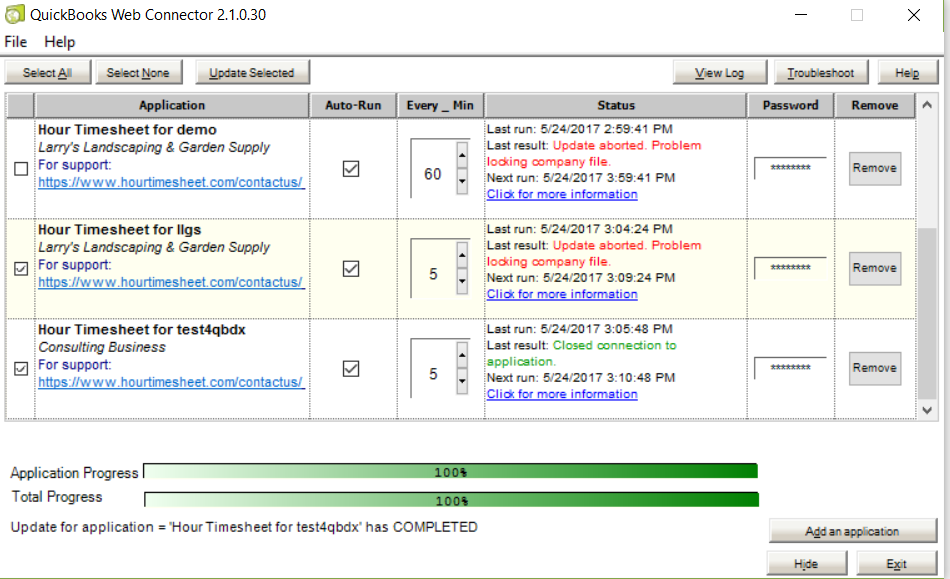

Deploy timekeeping systems designed for government contractor requirements with hierarchical activity codes enabling employees to classify work by both contract deliverable and activity type. For example, an engineer might charge time to “Phase II Prototype Development – Design Activities” versus “Phase II Manufacturing Analysis – Production Process Development.” This granular classification provides the documentation supporting cost allowability determinations when research activities approach production boundaries.

Create clear guidance for employees explaining research versus production distinctions with specific examples relevant to your technology and deliverables. When employees understand the compliance implications of cost classifications, they make better real-time decisions about timesheet coding reducing after-the-fact reclassification requirements.

Step 2: Establish Material Cost Tracking and Disposition Controls

Develop comprehensive material tracking systems capturing purchase purpose, storage location, and consumption disposition for all materials supporting Phase II work. Your inventory system must distinguish between materials purchased for prototype development, materials acquired for testing and validation, and materials intended for future production—even when physically identical items come from the same supplier.

Implement lot tracking or serial number controls for high-value materials enabling precise accounting of which specific items were consumed in Phase II activities versus retained for production inventory or commercial use. When DCAA auditors examine material costs, they’ll trace individual purchases from procurement through consumption, requiring your records to demonstrate materials charged to Phase II were actually used in contract performance.

Create systematic procedures for periodic physical inventory verification confirming materials charged to Phase II contracts aren’t sitting in production inventory or incorporated into commercial products. DCAA compliance explained emphasizes prevention through systematic controls rather than retroactive justification when auditors question cost classifications.

Step 3: Deploy Percentage-of-Work Monitoring and Documentation Systems

Build automated tracking systems monitoring your percentage-of-work compliance throughout contract performance rather than calculating ratios only when preparing completion reports. SBIR/STTR contracts typically require prime contractors to perform minimum percentages of work (often 40% for SBIR, 30% for STTR) with additional requirements for small business partners in STTR awards. Your cost accounting system must track work performance by organizational entity providing real-time visibility into percentage-of-work metrics.

Create monthly management reports showing cumulative labor hours and direct costs by performing organization with trending analysis projecting whether current work distribution will satisfy percentage requirements at contract completion. Early identification of percentage-of-work risks enables corrective action through work reallocation or subcontract scope modifications before non-compliance becomes irreversible.

Maintain detailed documentation supporting percentage-of-work calculations including labor distribution analysis, cost allocation methodologies, and work performance verification. When agencies verify percentage-of-work compliance, they expect detailed substantiation demonstrating calculations accurately reflect actual work performance rather than convenient cost allocations achieving required percentages.

Step 4: Create Commercial Activity Cost Segregation Procedures

Implement systematic procedures segregating commercial development costs from Phase II contract costs when your company pursues commercial applications concurrent with government-funded research. Your cost accounting system must maintain clear boundaries between contract-funded activities and company-funded commercialization efforts even when both activities involve the same personnel, facilities, and technology.

Establish approval workflows requiring management review when employees charge time to Phase II contracts while simultaneously working on commercial product development, marketing, or business development activities. Create documentation requirements explaining the specific Phase II deliverables being advanced and how work differs from commercial activities using similar technology.

Build facility and equipment usage tracking systems when shared resources support both Phase II research and commercial production. Usage-based allocation methodologies demonstrate compliance with cost accounting standards while ensuring Phase II contracts bear only their proportionate share of shared costs.

Step 5: Establish Transition Planning and Cost Reclassification Procedures

Develop systematic procedures for identifying when Phase II activities transition from allowable research to unallowable production requiring cost reclassification or contract scope modification. Create quarterly technical and financial reviews examining work activities against research versus production criteria, identifying activities approaching cost allowability boundaries before significant costs accumulate.

Implement proactive communication procedures notifying program managers when technical progress creates potential cost classification changes. Early discussion enables contract modifications expanding scope to cover activities initially appearing to be production but falling within agency’s commercialization support objectives. Many agencies provide Phase III or follow-on production contracts specifically addressing the transition from research to production—proactive planning positions you for these opportunities rather than discovering compliance issues during audits.

The Investment in Phase II Accounting Compliance

Building robust SBIR/STTR Phase II accounting systems costs between $35,000 and $95,000 for small contractors depending on existing system capabilities, technical complexity, and commercial activity integration requirements. This includes implementing activity-based cost tracking, material disposition controls, percentage-of-work monitoring, and commercial cost segregation procedures. Annual maintenance typically runs $12,000 to $25,000 for ongoing system refinement and compliance monitoring.

Let me show you the value: contractors with excellent Phase II accounting systems win Phase III production contracts because agency program managers trust their cost reporting accuracy and cost control capabilities. They secure follow-on SBIR/STTR awards because successful Phase II performance demonstrated through reliable cost management makes them preferred proposers. They commercialize technologies effectively because the discipline of segregating research from production costs during Phase II creates operational capabilities supporting efficient commercial manufacturing.

Contractors without adequate systems face cost disallowance during post-award audits requiring contract negotiations reducing final payments, percentage-of-work violations forcing last-minute subcontract modifications disrupting technical performance, and commercial activity contamination questions delaying contract closeout for months while you reconstruct cost segregation justifications. These compliance issues don’t just affect the current contract—they damage your reputation with program managers affecting future award opportunities.

Understanding SBIR/STTR Program Jurisdiction

SBIR and STTR programs operate across eleven federal agencies including DOD, NASA, Department of Energy, National Science Foundation, and Department of Health and Human Services. Each agency administers its program independently with agency-specific procedures, but all agencies use identical cost principles under FAR Part 31 creating uniform cost accounting requirements. Your cost accounting system must satisfy DOD’s requirements whether you’re performing contracts for Army, Air Force Research Laboratory, or Missile Defense Agency—and those same systems work for NASA, DOE, or NSF SBIR/STTR contracts.

Multi-agency SBIR/STTR contractors benefit from standardized cost accounting approaches applicable across your portfolio rather than customizing systems for each agency’s perceived preferences. The fundamental requirement—proving costs charged to contracts are reasonable, allocable, and allowable—remains constant regardless of which agency funds your research.

Your Path to SBIR/STTR Success

The SBIR/STTR Phase II landscape rewards contractors who build robust cost accounting systems early in their government contracting journey. Small companies winning first Phase II awards face steep learning curves understanding government cost accounting requirements while managing ambitious technical programs. The contractors who succeed invest in proper systems before problems emerge rather than treating accounting as an administrative afterthought behind technical performance.

Your Phase II contract represents more than research funding—it’s validation of your technology’s potential and your company’s capability to deliver on government programs. Protecting that validation requires demonstrating cost management competence through systematic accounting supporting every dollar claimed.

For SBIR/STTR contractors managing Phase II accounting requirements while advancing technology development, Hour Timesheet provides solutions specifically designed for research-focused small businesses. Our platform delivers the activity-based timekeeping, cost segregation capabilities, and compliance monitoring tools Phase II contractors need while remaining affordable for small company budgets.

Your innovation deserves professional cost accounting systems supporting both technical success and regulatory compliance.

Additional Resources

Related Hour Timesheet Articles:

- DCAA Compliance Requirements for Contractors

- DCAA Compliance Explained

- DCAA Timekeeping Requirements

Official Regulatory References:

- FAR 31.205-18 – Independent research and development costs

- FAR 35.017 – SBIR and STTR programs

- 13 CFR 121.702 – SBIR/STTR eligibility

- SBIR.gov – Official SBIR/STTR Website

- DCAA Contract Audit Manual