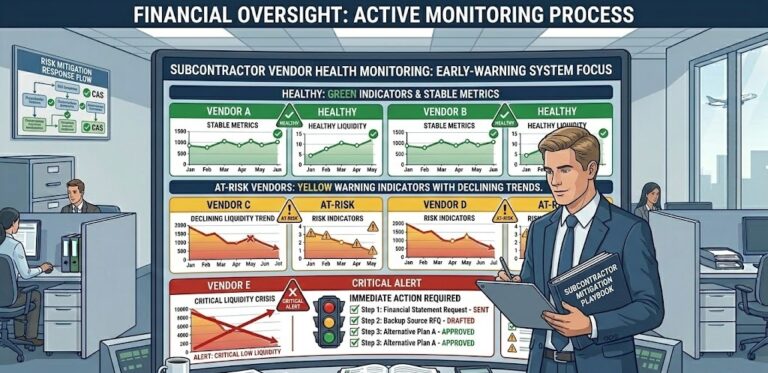

Subcontractor Oversight: Monitoring Financial Health for DCAA Compliance

Your company awarded a $4.2 million critical path subcontract to a vendor whose financial statements showed strong revenues and growth—but during contract execution, the subcontractor declared bankruptcy, defaulted on deliverables, and left you scrambling to find replacement sources while absorbing $680,000 in reprocurement costs that DCAA questioned as avoidable contractor mismanagement because you failed to…