A Virginia-based defense contractor learned this lesson at a cost of $23 million in questioned costs and an 18-month suspension from federal contracting. Their crime? Implementing a weekly time entry system that violated fundamental DCAA timekeeping requirements under 48 CFR 31.201-4 and Cost Accounting Standard (CAS) 418. The Defense Contract Audit Agency (DCAA) rejected their entire accounting system, triggering contract suspensions across multiple federal agencies and forcing the contractor into compliance remediation that took nearly two years to complete.

This case demonstrates why weekly time entry systems represent one of the most costly compliance failures in federal contracting. Deficient timekeeping is the reason for contractors’ failing DCAA accounting system audits, and weekly systems violate core regulatory requirements that have been consistent across all federal agencies since the implementation of the Federal Acquisition Regulation.

Legal Foundation: The Regulatory Framework That Demands Daily Entry

Federal contractors operate under strict timekeeping requirements established in multiple regulatory authorities that explicitly mandate contemporaneous time recording. These regulations create an interlocking compliance framework that leaves no room for interpretation regarding weekly time entry systems.

48 CFR 31.201-4 – Determining Allocability establishes the foundational requirement that costs must be “incurred for the same purpose in like circumstances.” Weekly time entry systems fail this test because they require employees to reconstruct time allocations days after work performance, creating inherent inaccuracy in cost allocation that violates the regulation’s requirement for precise cost tracking.

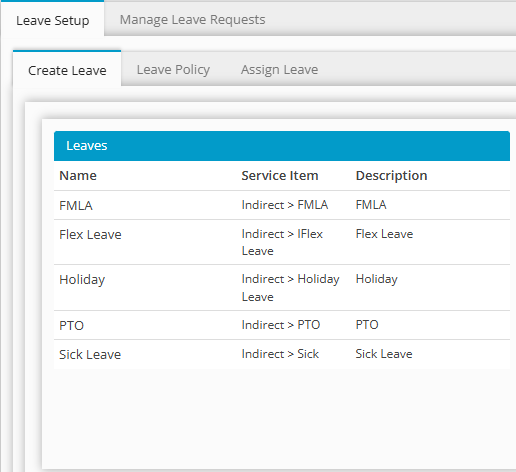

Cost Accounting Standard 418 – Allocation of Direct and Indirect Costs under 48 CFR 99.418 mandates that “costs incurred for the same purpose in like circumstances shall be treated consistently.” Weekly systems create inconsistent treatment because they allow different employees to apply different reconstruction methodologies, violating the standard’s consistency requirements. CAS 418 specifically requires that timekeeping systems provide “adequate support” for cost allocations—a requirement that weekly reconstruction cannot satisfy.

10 USC 2324(f)(1) – the Truth in Negotiations Act implementation—requires contractors to maintain accounting systems that provide “adequate cost data.” Weekly time entry fails this standard because reconstructed time allocations cannot provide the accuracy level required for adequate cost data, particularly in multi-contract environments where precise labor allocation determines contract profitability and compliance.

Common Violation Patterns: How Contractors Trigger DCAA Rejection

DCAA auditors consistently identify five violation patterns in weekly time entry systems that trigger immediate system rejection and questioned cost determinations.

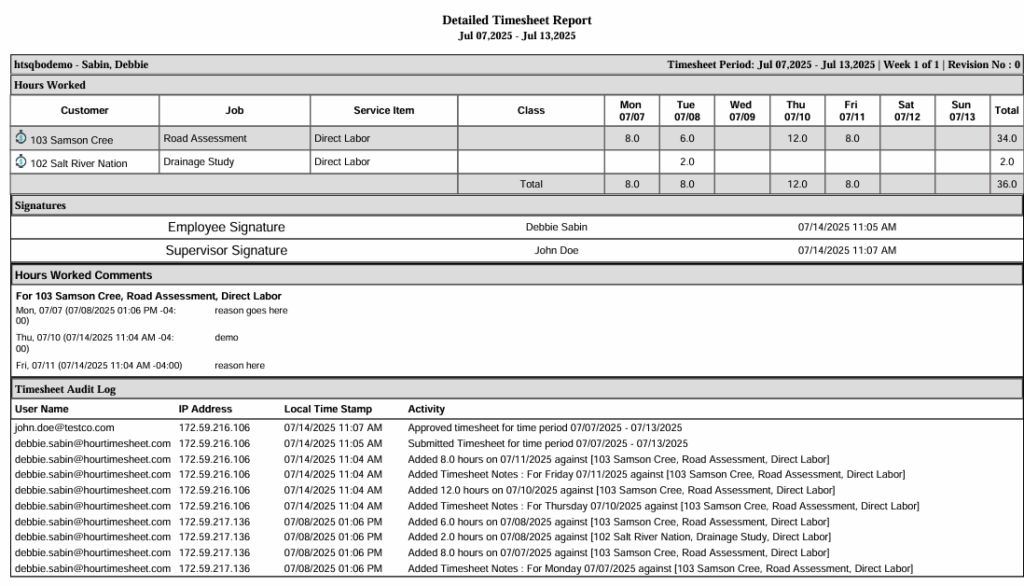

Reconstruction-Based Time Allocation represents the most fundamental violation. When employees enter time on Friday for the entire week, they inevitably reconstruct time allocations based on memory rather than contemporaneous recording. DCAA auditors document this through employee interviews and system testing, demonstrating that weekly systems cannot provide the accuracy required under 48 CFR 31.201-4.

Cross-Contract Allocation Errors occur systematically in weekly systems because employees cannot accurately recall daily task switching between different contracts or projects. This creates CAS 418 violations when similar work receives different cost treatment based on reconstruction timing rather than actual work performance patterns.

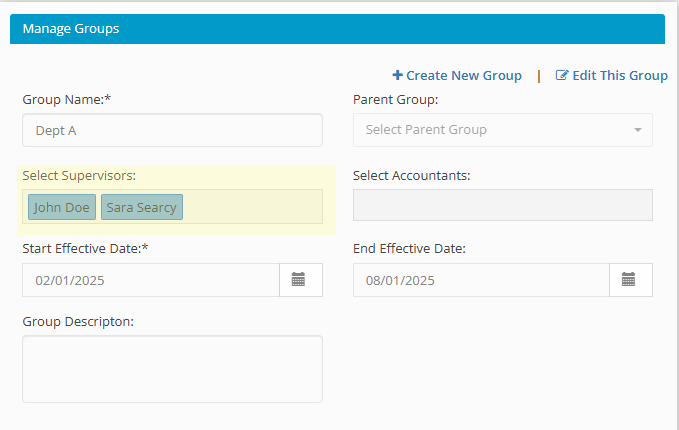

Supervisory Review Inadequacy emerges when supervisors approve weekly timesheets without daily visibility into actual work performance. This violates the supervisory review requirements under DCAA guidance, which demands that supervisors have sufficient knowledge of employee activities to validate time allocations—impossible with weekly reconstruction.

Documentation Deficiencies manifest when weekly systems lack contemporaneous supporting documentation for time allocations. DCAA requires that timekeeping systems maintain adequate supporting records, but weekly systems cannot produce contemporaneous documentation because time entry occurs days after work performance.

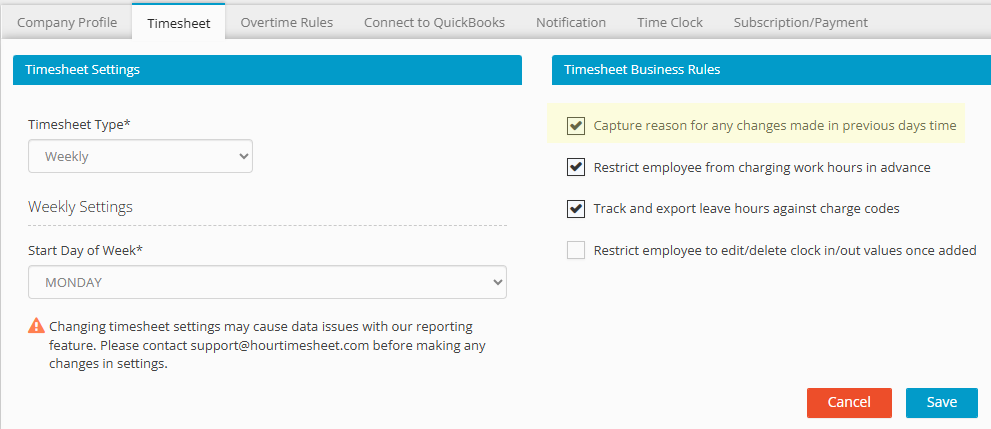

System Control Weaknesses appear in weekly systems that lack adequate controls to prevent retroactive time manipulation. Without daily time entry requirements, these systems typically allow unlimited retroactive changes without appropriate audit trails, violating internal control requirements under federal cost accounting standards.

Step-by-Step Compliance Requirements: Building DCAA-Acceptable Daily Systems

Compliance with DCAA timekeeping requirements demands implementation of daily time entry systems with specific control features that satisfy all regulatory requirements across federal agencies.

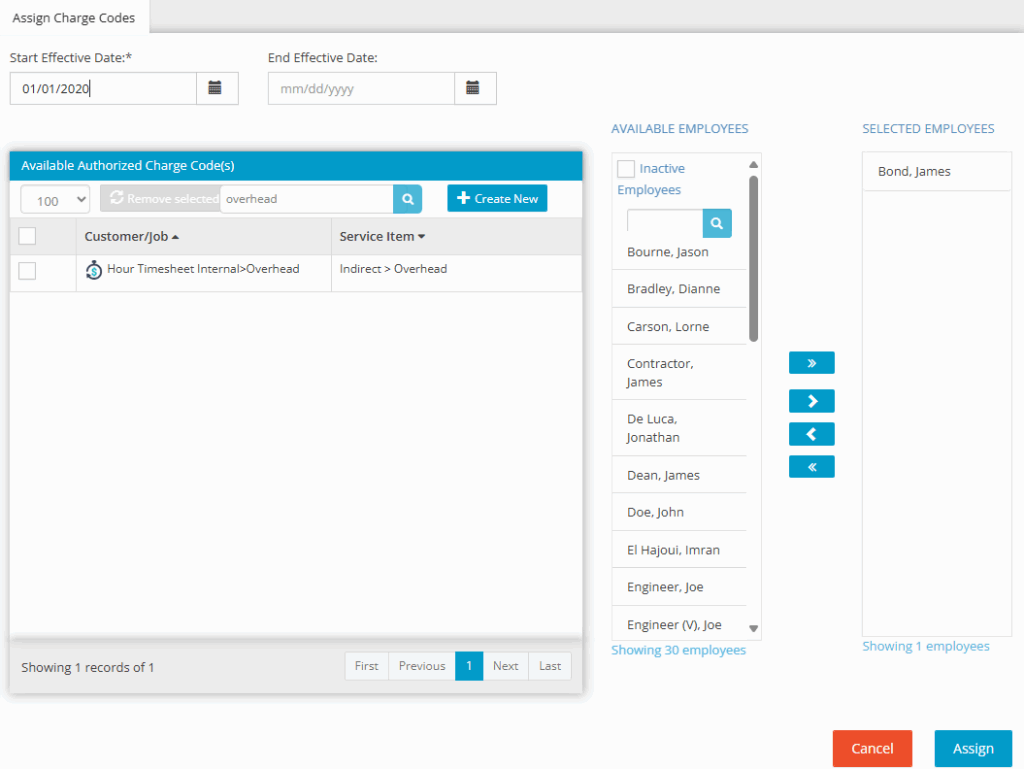

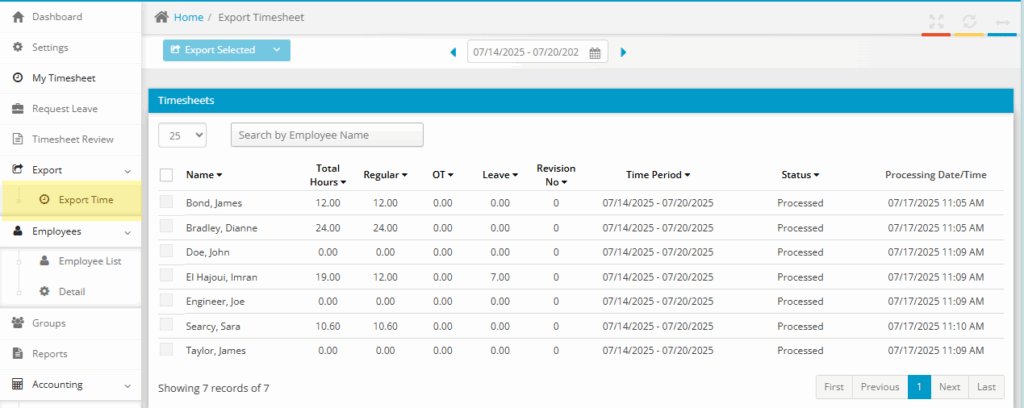

Daily Time Entry Mandate: Implement systems that require employees to enter time daily, preferably at task completion or by close of business each day. This satisfies the contemporaneous recording requirement under 48 CFR 31.201-4 and eliminates reconstruction-based allocation errors that trigger DCAA rejection. The system must prevent time entry for future dates and limit retroactive entries to the same business day.

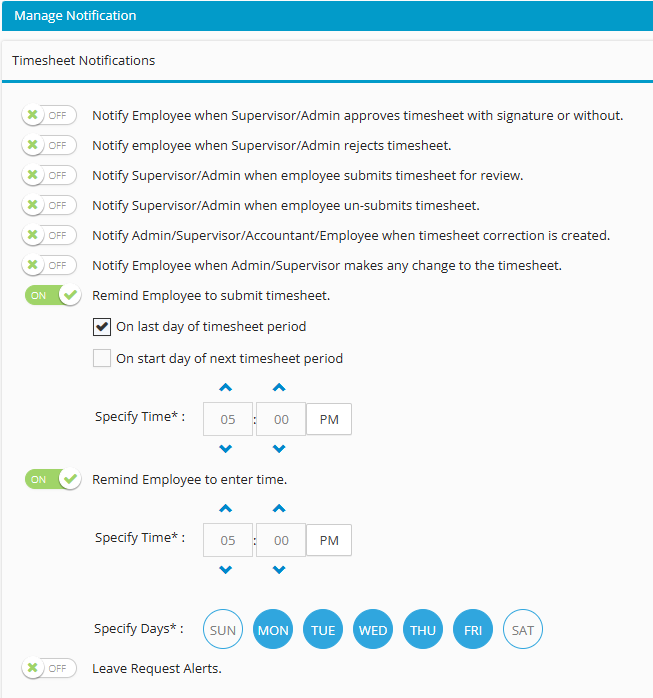

Supervisory Approval Controls: Establish supervisory review processes that occur within 72 hours of time entry, ensuring supervisors have sufficient knowledge of employee activities to validate allocations. This control satisfies DCAA requirements for adequate supervisory oversight and creates the documentation trail required for cost accounting standard compliance. Supervisors must certify that reviewed time allocations reflect actual work performed.

Audit Trail Maintenance: Configure systems to maintain complete audit trails for all time entry modifications, including original entries, changes, change dates, change reasons, and approver identification. This documentation satisfies the supporting record requirements under CAS 418 and provides DCAA auditors with the evidence trail necessary to validate cost allocations during compliance reviews.

Cross-Reference Documentation: Implement procedures that cross-reference time entries with project documentation, work orders, meeting records, and other contemporaneous records that support time allocations. This creates the “adequate support” required under CAS 418 and demonstrates that time allocations reflect actual work performance rather than reconstruction or estimation.

System Security Controls: Establish role-based access controls that prevent unauthorized time modifications and ensure appropriate segregation of duties between time entry, approval, and payroll processing functions. These controls satisfy internal control requirements and prevent the system manipulation issues that commonly trigger DCAA system adequacy determinations.

Cost of Non-Compliance vs. Cost of Compliance: The Financial Reality

Non-compliance with DCAA timekeeping requirements creates financial exposure that far exceeds compliance implementation costs across multiple regulatory enforcement mechanisms.

Questioned Cost Exposure represents the immediate financial impact when DCAA rejects weekly time entry systems. Non-compliance can lead to civil or even criminal penalties, with questioned costs typically ranging from $500,000 to $50 million depending on contract volume and duration of non-compliance. These questioned costs require contractor response, often including independent public accountant validation, creating additional costs of $50,000 to $200,000 per response.

Contract Suspension Consequences trigger when DCAA determines that weekly time entry systems create inadequate accounting systems. Failing to meet DCAA timekeeping requirements can result in refusal of future contracts, with suspensions lasting 12-24 months while contractors implement compliance remediation. During suspension periods, contractors cannot compete for new federal work, creating opportunity costs that often exceed $10 million annually for mid-sized contractors.

Legal and Professional Services Costs accumulate during compliance remediation, typically ranging from $200,000 to $1 million for system redesign, implementation, and DCAA re-audit processes. These costs include legal representation, accounting system consulting, software implementation, training, and ongoing compliance monitoring required to restore contractor status.

Daily System Implementation Costs typically range from $15,000 to $75,000 for software licensing, configuration, training, and policy implementation. Annual maintenance costs range from $3,000 to $15,000 depending on contractor size and complexity. These compliance costs represent less than 0.1% of typical contract values while preventing millions in potential questioned costs and suspension consequences.

ROI Analysis demonstrates that compliance investment delivers 20:1 to 100:1 return when measured against non-compliance consequences. Weekly system rejection creates financial exposure averaging $5-15 million per contractor, while daily system implementation costs average $25,000-50,000, creating clear economic justification for compliance investment.

Multi-State Federal Jurisdiction: Nationwide Regulatory Enforcement

DCAA timekeeping requirements apply uniformly across all federal contracts regardless of contractor location, creating nationwide compliance obligations that affect contractors in all 50 states and territories.

Federal Acquisition Regulation Authority under 48 CFR extends to all executive branch agencies, including Department of Defense, Department of Homeland Security, General Services Administration, and civilian agencies. Contractors performing work for any federal agency must comply with identical timekeeping requirements, regardless of contract location or contractor headquarters state.

Defense Contract Management Agency Coordination ensures that DCAA timekeeping determinations affect contractor eligibility across all federal agencies. A timekeeping system rejection in one state immediately impacts contractor ability to perform federal work nationwide, creating compliance consequences that transcend individual contract locations or agency relationships through the Defense Contract Management Agency coordination process.

State Jurisdiction Limitations do not apply to federal contract compliance requirements. State timekeeping laws, wage and hour regulations, and employment requirements represent minimum standards that cannot override federal contractor obligations under FAR and CAS requirements. Contractors must satisfy both state and federal requirements, with federal standards typically creating more stringent obligations.

Interstate Contract Performance requires consistent timekeeping compliance across all performance locations. Contractors with operations in multiple states must implement identical daily time entry systems nationwide to ensure compliance continuity and prevent audit findings based on inconsistent timekeeping practices across different locations.

Territory and International Application extends DCAA requirements to contractors performing federal work in U.S. territories, overseas locations, and international settings. The regulatory framework applies regardless of work location, creating uniform compliance obligations for all federal contract performance regardless of geographic considerations.

The $23 million lesson learned by the Virginia defense contractor serves as clear precedent: weekly time entry systems represent prohibited timekeeping practices under federal regulations. Contractors operating under FAR and CAS requirements must implement daily time entry systems with adequate controls, documentation, and supervisory review to satisfy DCAA compliance standards and avoid the substantial financial consequences of non-compliance across all federal contracting jurisdictions.

Ready to Implement DCAA-Compliant Timekeeping?

Hour Timesheet provides the integrated compliance solution your organization needs to meet critical September deadlines. Our platform ensures accurate labor cost capture, maintains year-end documentation requirements, and provides the audit trails government auditors demand during fiscal year-end reviews.

Don’t risk missing crucial September compliance deadlines. Hour Timesheet’s proven system helps contractors maintain compliant practices while streamlining year-end preparation and submission processes.

Start Your Free Trial Today see how Hour Timesheet ensures your organization stays DCAA-compliant and audit-ready

In September 2022, a major aerospace contractor faced $47.2 million in penalties when

In September 2022, a major aerospace contractor faced $47.2 million in penalties when