Legal and Consultant Fees: Documentation Required to Avoid Disallowance

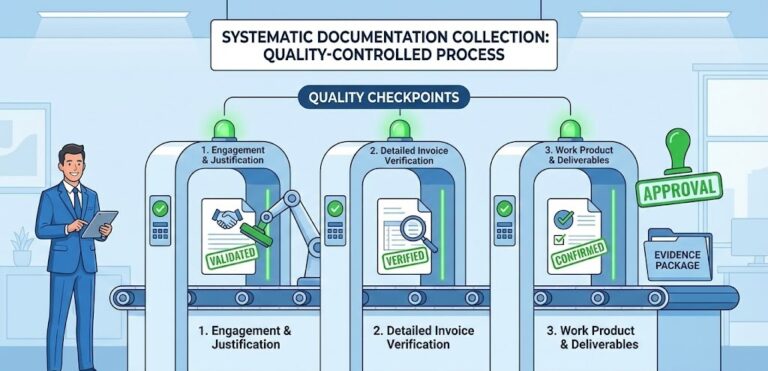

Your company incurred $145,000 in legal fees defending against an employment discrimination claim and $78,000 in consultant fees for “business advisory services”—both charged to indirect pools allocating across government contracts. During your incurred cost audit, DCAA questioned the entire $223,000, citing inadequate documentation supporting business purpose, lack of evidence demonstrating services were necessary and reasonable,…