If you’re a government contractor, few phrases can trigger anxiety quite like “DCAA floor check.” Whether you’re new to government contracting or a seasoned professional, understanding what happens during these audits and how to prepare for them is crucial for maintaining compliance and protecting your contracts.

What Is a DCAA Floor Check?

A DCAA (Defense Contract Audit Agency) floor check is an unannounced audit where DCAA representatives physically verify that employees charging time to government contracts are actually present and working on the tasks they’ve recorded. Think of it as a spot inspection designed to validate the accuracy of your timekeeping practices and labor charging procedures.

These audits serve as a critical control mechanism to ensure that taxpayer dollars allocated to government contracts are being used appropriately and that contractors are maintaining accurate records of labor charges.

Why Do Floor Checks Happen?

The DCAA conducts floor checks for several reasons:

Routine Compliance Verification: Floor checks are a standard part of DCAA’s oversight responsibilities. Even if you’ve done nothing wrong, you may still experience routine floor checks as part of normal audit procedures.

Risk-Based Selection: Contractors with higher-risk profiles, larger contracts, or those new to government contracting may face more frequent floor checks.

Specific Concerns: Sometimes floor checks are triggered by specific issues identified during other audits, employee complaints, or inconsistencies in submitted documentation.

Random Selection: To maintain the integrity of the audit process, DCAA also conducts random floor checks without any specific triggering event.

What Happens During a Floor Check?

Understanding the floor check process can help reduce anxiety and ensure your team responds appropriately when auditors arrive.

The Arrival

DCAA auditors typically arrive unannounced during regular business hours. They’ll present their credentials and request to speak with a designated point of contact, usually someone from management or your contracts department. The unannounced nature is intentional – it ensures auditors see your actual day-to-day operations rather than a prepared presentation.

The Interview Process

Auditors will randomly select employees who have charged time to government contracts and conduct brief interviews. These conversations typically cover:

- Current work assignments and which contracts they’re supporting

- Their understanding of proper timekeeping procedures

- Verification that they’re working on the tasks recorded in their timesheets

- Their physical presence in the location indicated by their time records

- Knowledge of company policies regarding labor charging

Employees might be asked to show their current timesheet or explain their recent time charges. The auditor may also request to see work products or evidence of the tasks being performed.

Documentation Review

Beyond employee interviews, auditors will examine various records and documents:

- Current timesheets and labor distribution reports

- Work authorization documents

- Project assignments and task orders

- Company timekeeping policies and procedures

- Training records related to timekeeping compliance

- Internal audit or review documentation

Management Discussion

After completing their fieldwork, auditors typically conduct an exit interview with management to discuss preliminary findings, ask clarifying questions, and provide initial feedback about any concerns identified during the floor check.

Common Issues Auditors Look For

Being aware of what auditors focus on can help you identify and address potential problems before they become findings.

Ghost Employees: Auditors verify that employees charging time are real people actually performing work. They’ll check for employees who are on vacation, sick leave, or otherwise absent but still showing productive hours charged to contracts.

Mischarging: This includes employees working on one contract while charging time to another, charging indirect tasks to direct contracts, or charging unallowable activities to government contracts.

Timesheet Accuracy: Auditors examine whether employees are recording time contemporaneously (as work is performed) rather than recreating timesheets after the fact. They also check for patterns suggesting fabricated entries.

Unauthorized Work: Employees performing tasks outside their authorized scope or working on contracts they’re not assigned to can trigger significant findings.

Policy Compliance: Auditors assess whether employees understand and follow company timekeeping policies, including proper approval processes and correction procedures.

How to Prepare for Floor Checks

While floor checks are unannounced, maintaining ongoing readiness is your best defense.

Establish Strong Timekeeping Policies

Develop comprehensive, clear policies that address:

- Daily time recording requirements

- Proper labor charging procedures

- Guidelines for splitting time between projects

- Procedures for corrections and adjustments

- Consequences for non-compliance

Make these policies easily accessible and ensure they’re regularly updated to reflect current regulations and contract requirements.

Implement Regular Training

Conduct timekeeping training for all employees, not just those currently working on government contracts. Training should cover:

- Proper time recording procedures

- Understanding of direct vs. indirect charges

- Contract-specific requirements

- Ethical responsibilities in government contracting

- How to respond during a floor check

Document all training sessions and maintain records of employee participation.

Conduct Internal Reviews

Don’t wait for DCAA to find problems. Implement your own internal floor checks and timekeeping audits. This helps you:

- Identify and correct issues before official audits

- Familiarize employees with the floor check process

- Demonstrate a culture of compliance to auditors

- Build confidence in your systems

Maintain Supporting Documentation

Ensure work authorizations, project assignments, and task orders are current and readily accessible. Employees should know where to find documentation supporting their time charges, and managers should regularly verify that assignments match timesheet entries.

Create a Response Plan

Develop a written procedure for handling DCAA visits that includes:

- Designated points of contact for auditors

- Employee notification procedures

- Document gathering responsibilities

- Guidelines for employee interactions with auditors

- Management review and response protocols

Best Practices for Success

Foster a Compliance Culture: Make accurate timekeeping a core value of your organization. When employees understand the importance of compliance beyond just avoiding penalties, they’re more likely to maintain accurate records consistently.

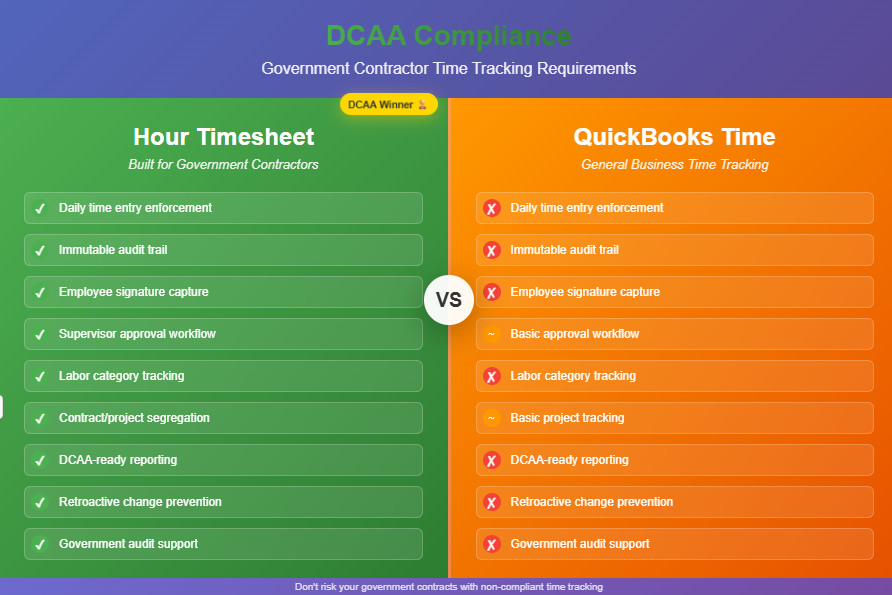

Use Technology Wisely: Implement automated timekeeping systems that include built-in controls, audit trails, and real-time reporting capabilities. These systems can flag potential issues before they become audit findings.

Communicate Regularly: Keep employees informed about timekeeping requirements and any changes to policies or procedures. Regular reminders about proper timekeeping practices help maintain awareness and compliance.

Document Everything: Maintain detailed records of all timekeeping-related activities, including training, internal audits, corrective actions, and policy updates. Comprehensive documentation demonstrates your commitment to compliance.

Address Issues Promptly: When you identify timekeeping problems, address them immediately. Document the issue, the corrective action taken, and steps to prevent recurrence. Auditors look favorably on contractors who self-identify and correct problems.

What to Do When Auditors Arrive

Despite your best preparation, the arrival of DCAA auditors can create stress. Here’s how to handle the situation professionally:

Stay Calm and Cooperative: Train your team to remain professional and cooperative. Attempting to delay or obstruct auditors will only raise suspicions and could lead to expanded audit scope.

Provide Requested Information: Supply documents and information as requested, but don’t volunteer information beyond what’s asked. If you need time to gather documents, communicate realistic timeframes to the auditor.

Be Honest and Direct: Encourage employees to answer questions truthfully and directly. If someone doesn’t know an answer, they should say so rather than speculate or guess.

Take Notes: Document the audit process, including who was interviewed, what documents were reviewed, and any concerns raised by auditors. These notes can be valuable for follow-up actions and future preparation.

Follow Up Appropriately: After the floor check, review any findings with your team, implement necessary corrective actions, and document your response to any issues identified.

Conclusion

DCAA floor checks don’t have to be a source of fear for government contractors. By understanding the process, maintaining strong timekeeping practices, and fostering a culture of compliance, you can approach these audits with confidence. Remember, DCAA’s goal isn’t to catch you doing something wrong – it’s to ensure that government contracts are executed properly and that taxpayer funds are used appropriately.

The key to success is preparation and consistency. Treat every day as if a floor check could happen, because it could. When your timekeeping practices are accurate, well-documented, and consistently followed, floor checks become just another routine part of government contracting rather than a crisis to be managed.

By implementing the strategies outlined in this guide, you’ll not only be better prepared for DCAA floor checks but also build stronger overall contract management practices that benefit your entire organization. Remember, good timekeeping isn’t just about compliance – it’s about building trust with your government customers and maintaining the integrity that’s essential for long-term success in government contracting.