A major defense contractor’s systematic misallocation of overtime premium costs resulted in an $8.7 million settlement with the Department of Justice after DCAA auditors discovered the company had improperly charged overtime premiums directly to cost-plus contracts while allocating the same costs to overhead pools on fixed-price work. This violation pattern, which DOJ characterized as “knowingly submitting false claims,” demonstrates the severe financial consequences contractors face when overtime premium allocation practices violate established cost accounting standards and federal acquisition regulations.

The regulatory framework governing overtime premium cost allocation has remained fundamentally unchanged for decades, yet continues to generate the highest frequency of DCAA audit exceptions and DOJ enforcement actions among cost accounting violations. With False Claims Act penalties now reaching $27,894 per violation and contractors facing average settlements of $8.4 million for systematic cost allocation errors, understanding the precise requirements for overtime premium treatment has become critical for maintaining federal contracting eligibility and avoiding catastrophic financial exposure.

Legal Foundation: The Regulatory Architecture Governing Overtime Premium Allocation

The statutory and regulatory framework establishing overtime premium cost allocation requirements creates a complex compliance environment that demands precise adherence to multiple interdependent cost accounting standards and federal acquisition regulations.

FAR 31.205-6 – Compensation for personal services establishes the fundamental principle that compensation costs, including overtime premiums, must be reasonable, allocable, and consistently applied in accordance with the contractor’s established compensation practices. This regulation specifically requires that overtime compensation conform to the contractor’s established compensation plan and that any overtime premium costs be allocated in a manner consistent with the relative benefits received by different contract types and customer categories.

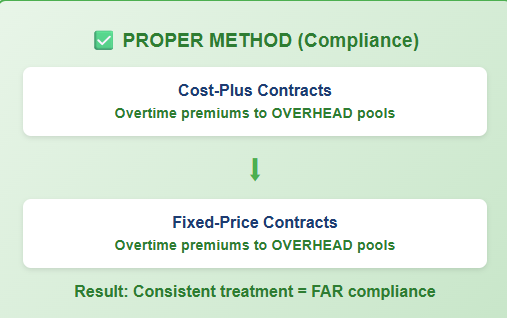

CAS 418 – Allocation of Direct and Indirect Costs governs the fundamental allocation methodology that determines whether overtime premium costs constitute direct charges allowable to specific contracts or indirect costs requiring allocation through overhead pools. Under CAS 418, overtime premiums can only be charged directly to contracts when the need for overtime work is specifically attributable to the requirements of particular contracts, and the contractor maintains consistent practices for treating similar overtime situations across all contract types.

10 USC 2324 – Allowable costs under defense contracts provides DCAA with statutory authority to examine contractor cost allocation practices and determines that overtime premium costs are subject to the same allowability standards as other forms of contractor compensation. This statute specifically empowers auditors to verify that overtime premium allocation practices comply with applicable cost accounting standards and do not result in preferential treatment of government contracts over commercial work or vice versa.

These regulatory requirements apply uniformly across all federal jurisdictions, creating consistent national compliance standards from aerospace contractors in California’s defense corridor to shipbuilding facilities in Virginia’s maritime industrial base, eliminating any geographical variations in overtime premium allocation requirements.

Common Overtime Premium Violation Patterns: The $8.7 Million Error Categories

DCAA auditors have documented recurring violation patterns in overtime premium cost allocation that consistently result in False Claims Act investigations and substantial financial penalties for government contractors.

Pattern 1: Preferential Direct Charging occurs when contractors systematically charge overtime premiums directly to cost-reimbursable government contracts while treating identical overtime costs as indirect expenses on fixed-price or commercial work. This practice violates CAS 418’s consistency requirements and creates the inference that contractors are manipulating cost allocation to maximize government reimbursement at the expense of other customers.

Pattern 2: Inconsistent Overhead Allocation emerges when contractors include overtime premiums in overhead pools for some contracts while excluding similar costs from overhead calculations for other work. The most common manifestation involves excluding overtime premiums from overhead pools used to price fixed-price government contracts while including these costs in pools allocated to cost-reimbursable work, creating artificial cost advantages during competitive bidding.

Pattern 3: Contract-Specific Overtime Justification Failures present enforcement exposure when contractors charge overtime premiums directly to contracts without maintaining adequate documentation demonstrating that the overtime work was specifically required by contract performance requirements rather than general business operations. DCAA requires contemporaneous documentation showing the direct relationship between overtime work and specific contract deliverables.

Pattern 4: Cross-Contract Subsidization involves using overtime premium costs from one contract to subsidize performance on other contracts through manipulative allocation methodologies. This typically occurs when contractors spread overtime costs incurred for specific contract requirements across broader overhead pools, effectively forcing other customers to subsidize contract-specific performance issues.

Current enforcement data indicates that contractors engaging in these violation patterns face average penalties of $8.4 million per case, with individual settlements ranging from $2.1 million to $23.7 million depending on the duration and scope of the allocation violations discovered during DCAA audits.

Step-by-Step Overtime Premium Compliance Requirements

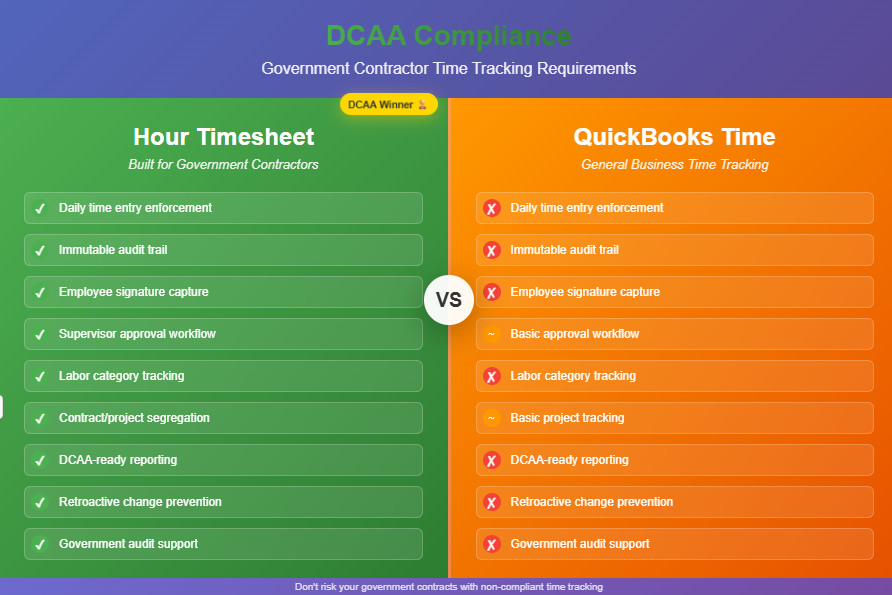

Step 1: Establish Contract-Specific Overtime Justification Documentation Systems Deploy comprehensive documentation systems that capture the specific contractual requirements driving overtime work for each instance of premium compensation. The system must maintain contemporaneous records linking overtime work to specific contract deliverables, customer requirements, or performance deadlines that necessitate work beyond standard hours. Documentation must include detailed justification for why the overtime work benefits specific contracts rather than general business operations, satisfying CAS 418 allocability requirements.

Step 2: Implement Consistent Overtime Cost Classification Methodologies Create standardized procedures for classifying overtime premium costs as either direct contract costs or indirect overhead expenses based on objective criteria rather than contract type or customer category. The methodology must apply identical classification logic to government and commercial work, cost-reimbursable and fixed-price contracts, and all customer categories to satisfy FAR 31.205-6 consistency requirements while avoiding preferential cost treatment that triggers False Claims Act exposure.

Step 3: Deploy Real-Time Overtime Allocation Monitoring Systems Establish automated monitoring systems that track overtime premium allocation patterns across all contract types and customer categories, identifying potential consistency violations before they develop into systematic allocation practices. The monitoring system must generate exception reports when overtime allocation patterns deviate from established allocation criteria or when allocation percentages vary significantly between similar contract types without documented justification.

Step 4: Create Comprehensive Overtime Premium Audit Trail Systems Maintain complete documentation chains for all overtime premium costs, including original timekeeping records, overtime authorization approvals, contract-specific justification documentation, allocation methodology applications, and supervisory review confirmations. The audit trail must demonstrate compliance with both the allocability requirements of CAS 418 and the allowability standards of FAR 31.205-6 while providing DCAA auditors with comprehensive visibility into overtime premium cost allocation decision-making processes.

Step 5: Establish Cross-Contract Allocation Verification Procedures Implement systematic verification procedures ensuring that overtime premium costs allocated to overhead pools receive consistent treatment across all contract types and customer categories. These procedures must include periodic reviews of allocation base calculations, verification that overhead pools include or exclude overtime premiums consistently, and documentation that allocation percentages applied to government contracts reflect the same methodologies used for commercial work, preventing cross-subsidization violations that trigger DOJ enforcement actions.

Financial Impact Analysis: Compliance Investment Versus Violation Consequences

The economic analysis demonstrates overwhelming financial incentives for comprehensive overtime premium compliance implementation compared to the severe penalty exposure associated with allocation violations.

Overtime Premium Compliance Implementation Costs typically range from $150,000 to $450,000 for mid-sized contractors, including enhanced timekeeping system modifications, allocation monitoring technology deployment, documentation system enhancements, training programs, and ongoing compliance verification procedures. These investments create scalable compliance frameworks that accommodate diverse contract portfolios while maintaining DCAA requirements across all customer categories.

Violation Penalty Exposure under current enforcement patterns creates catastrophic financial consequences for contractors with systematic overtime premium allocation errors. A contractor with 200 employees regularly working overtime could face penalties exceeding $2.8 million (100 violations × $27,894 maximum penalty) plus treble damages on all government overpayments identified during comprehensive audit investigations. When combined with suspension and debarment risks, total financial exposure frequently exceeds $15 million for systematic overtime premium violations.

Secondary Enforcement Consequences include enhanced audit frequencies, increased oversight requirements, and reputational damage that affects competitive positioning for future contract awards. With DOJ recovering record amounts from False Claims Act enforcement, contractors face elevated scrutiny requiring comprehensive overtime premium compliance attention to maintain federal contracting eligibility and competitive advantages.

The return on investment for overtime premium compliance systems consistently exceeds 600% when calculated against potential violation costs, making implementation a fundamental business requirement rather than optional risk mitigation for defense contractors maintaining overtime operations across multiple contract types and customer categories.

Multi-State and Federal Jurisdiction Enforcement Uniformity

DCAA’s enforcement authority maintains consistent overtime premium allocation requirements across all federal jurisdictions, creating uniform compliance obligations regardless of contractor geographic location or operational distribution patterns.

West Coast Regional Enforcement across California, Oregon, and Washington demonstrates particular scrutiny of aerospace and technology contractors whose project-driven work patterns generate significant overtime requirements. Enforcement actions have averaged $6.2 million per systematic overtime premium violation case, with enhanced focus on contract-specific overtime justification documentation and consistent allocation methodology application across government and commercial work portfolios.

East Coast Enforcement Characteristics spanning Virginia, Maryland, and the District of Columbia reflect the concentration of defense contractors and consulting firms where overtime premium allocation patterns often involve complex multi-contract work arrangements. Average settlements reach $7.8 million per case involving systematic overtime premium compliance failures, with particular attention to cross-contract subsidization prevention and overhead pool consistency requirements.

Gulf Coast Regional Patterns across Texas, Louisiana, and Alabama emphasize shipbuilding and energy contractors where overtime premium costs constitute significant portions of total labor expenses due to project completion pressures and customer delivery requirements. Enforcement focuses on contract-specific overtime justification accuracy and allocation base consistency, with average penalties of $5.4 million per systematic violation case.

Midwest Enforcement Trends spanning Illinois, Ohio, and Michigan target manufacturing and logistics contractors where overtime premium allocation must maintain accuracy across diverse production schedules and customer requirements. Violations typically involve inconsistent overhead allocation methodologies and preferential direct charging patterns, resulting in average settlements of $4.9 million per systematic violation case.

This geographic enforcement consistency reinforces the federal nature of overtime premium compliance requirements and eliminates regional variation assumptions contractors might consider when developing allocation policies and procedures.

2024-2025 Enforcement Priorities: Enhanced Detection Capabilities and Strategic Focus

DCAA’s enforcement priorities for 2024-2025 reflect sophisticated analytical capabilities and strategic concentration on systematic overtime premium violations rather than isolated allocation errors.

Advanced Data Analytics Integration enables pattern recognition across contractor populations and industry sectors, identifying overtime premium allocation trends that suggest coordinated compliance avoidance or systematic allocation manipulation schemes. This technological advancement requires contractors to ensure their overtime premium practices withstand statistical analysis across their entire contract portfolio rather than merely satisfy individual transaction reviews during traditional audit procedures.

Cross-Jurisdictional Compliance Analysis allows auditors to identify overtime premium allocation patterns spanning multiple geographic locations and contract types, revealing allocation schemes previously concealed within individual contract or facility analysis. Contractors must now consider the cumulative compliance pattern of their overtime premium allocation practices across all simultaneous government contracts and commercial work arrangements regardless of geographic distribution.

Real-Time Allocation Monitoring provides DCAA with immediate visibility into contractor overtime premium allocation systems, enabling intervention during allocation decision-making processes rather than retrospective audit discovery of systematic violations. This shift from post-performance review to concurrent oversight requires contractors to maintain continuous compliance rather than periodic compliance preparation for scheduled audit activities.

The convergence of enhanced detection capabilities with DOJ’s commitment to False Claims Act enforcement creates an unprecedented environment where overtime premium allocation violations face immediate discovery likelihood and severe financial consequences, making comprehensive compliance implementation an immediate operational necessity for all government contractors maintaining overtime operations across diverse contract portfolios and customer categories.