Your company submitted its annual incurred cost proposal six months late with incomplete schedules, unsupported indirect rate calculations, and missing audit trail documentation. DCAA rejected the submission as inadequate, suspending indirect rate negotiations for all your cost-reimbursement contracts while accumulated billing reserves exceeded $1.2 million—cash you legitimately earned but cannot invoice until DCAA completes rate audits that won’t start until you fix your submission. Here’s what contractors miss about incurred cost submissions: the annual ICE (Incurred Cost Electronically) filing isn’t optional paperwork you can delay or simplify—it’s a contractual obligation with specific regulatory requirements, mandatory schedules, and strict adequacy standards that determine whether DCAA will audit your rates, whether you can bill your full indirect costs, and whether cash flow from cost-reimbursement contracts supports business operations or creates financial strain through billing holds. Understanding how to prepare, document, and submit compliant incurred cost proposals isn’t about satisfying bureaucratic process—it’s about proving actual costs incurred during contract performance, supporting final indirect rate determinations enabling invoice settlement, and maintaining the government relationship that cost-reimbursement contracting requires through transparent financial reporting demonstrating fiscal responsibility.

The Legal Framework Governing Incurred Cost Submission Requirements

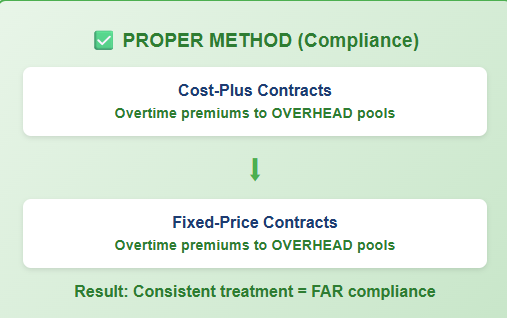

Federal contract clauses establish specific obligations for contractors to submit annual incurred cost proposals supporting final indirect rate determination. FAR 52.216-7, Allowable Cost and Payment, requires contractors to submit final indirect cost rate proposals within six months after their fiscal year end, using specified formats and including comprehensive schedules supporting rate calculations. This clause appears in virtually all cost-reimbursement contracts, making annual submissions contractual obligations rather than voluntary filings—missing deadlines or submitting inadequate packages violates contract terms with consequences including payment withholding and potential default.

The submission adequacy standards under FAR 42.705-1(b) establish that incurred cost proposals must include specific schedules organized in prescribed formats covering: indirect cost rate computation, general and administrative expenses, overhead allocation, direct contract costs, and supporting documentation enabling DCAA verification. DCAA developed detailed adequacy checklists contractors must satisfy before submissions qualify for audit, with inadequate submissions returned unprocessed regardless of contractor effort creating them. Understanding DCAA compliance requirements means recognizing that compliance involves both timely submission and adequate content meeting specific schedule and documentation requirements.

The electronic submission mandate under DCAA policy requires contractors to submit incurred cost proposals through the Department of Defense’s designated submission system—currently the Wide Area WorkFlow (WAWF) portal using the ICE module. Paper submissions are no longer accepted, with electronic filing mandatory regardless of contractor size or submission complexity. Technical compliance with electronic submission procedures, including proper file formats, required schedules, and system navigation, becomes a compliance requirement itself beyond the substantive rate calculation and documentation standards.

Cost Accounting Standard 406 governs cost accounting period requirements, establishing that contractors must consistently use fiscal periods for accumulating costs, maintain consistency in period definitions across accounting functions, and establish indirect rates covering defined accounting periods. Your incurred cost submission must reflect costs actually incurred during your fiscal year, calculated using consistent accounting period definitions that align with your disclosed practices and general ledger structure. Period inconsistencies—mixing calendar and fiscal years, charging costs to wrong periods, or calculating rates using mismatched cost and base periods—create fundamental CAS violations that DCAA flags during adequacy review.

What Contractors Must Understand About Incurred Cost Submission Challenges

Here’s what contractors miss about ICS preparation: creating adequate submissions requires year-round accounting discipline maintaining compliant cost accumulation, not year-end heroics trying to reconstruct rates from inadequate records. Your six-month deadline after fiscal year-end provides time for submission preparation and review, not time for implementing accounting systems, identifying unallowable costs, or developing indirect rate methodologies that should have existed during the year. Contractors attempting ICS preparation without proper accounting infrastructure discover they cannot create adequate submissions from inadequate source data, regardless of effort invested.

The schedule completeness problem creates immediate adequacy failures when contractors submit partial packages missing required schedules, providing summary data without supporting detail, or omitting documentation DCAA needs for verification. DCAA compliance explained emphasizes that DCAA’s adequacy checklist is non-negotiable—missing even one required schedule triggers inadequacy determination and submission return. The standard submission includes over fifteen specific schedules covering direct costs, indirect pools, allocation bases, contractor organization, facilities capital employed, and supporting reconciliations. Contractors treating ICS like tax returns focused only on rate calculations without comprehensive schedule packages guarantee inadequacy findings.

The unallowable cost identification challenge surfaces when contractors lack systematic procedures for identifying costs FAR prohibits charging to government contracts. This is where audits go sideways—contractors accumulate entertainment, lobbying, excessive compensation, and other unallowable costs in indirect pools, then submit rate proposals including prohibited expenses expecting DCAA to identify exclusions. However, DCAA expects contractors to identify and exclude unallowable costs before submission, with detailed schedules showing amounts excluded and explanatory notes supporting exclusion decisions. Submissions mixing allowable and unallowable costs without clear segregation face adequacy questions even when total rate impacts might be immaterial.

The allocation base accuracy problem emerges when contractors calculate indirect rates using allocation bases that don’t match actual costs accumulated in accounting systems or that fail to properly exclude unallowable direct costs, IR&D, and other adjustments. Your overhead rate denominator must equal your actual direct labor base excluding unallowable direct costs and other required adjustments, reconciled to general ledger accounts with audit trail documentation supporting base calculations. When allocation bases in ICS submissions don’t reconcile to general ledger accounts or include amounts requiring exclusion, DCAA questions whether rates accurately reflect cost accounting system results or whether submissions contain calculation errors creating unreliable rates.

The reconciliation inadequacy becomes apparent when contractors cannot demonstrate clear connection between rate proposal schedules and audited financial statements or general ledger trial balances. DCAA expects comprehensive reconciliations showing how ICS cost pools tie to specific general ledger accounts, how allocation bases reconcile to labor cost accumulations, and how submission amounts match audited financial data with explanations for any differences. Missing reconciliations suggest inadequate cost accumulation and potential rate calculation errors that prevent DCAA from accepting submissions as adequate for audit.

The supporting documentation gaps manifest when contractors submit rate schedules without underlying records supporting calculations including payroll summaries, trial balances, unallowable cost analyses, contract listings, and organizational charts. DCAA adequacy standards require specific supporting exhibits enabling verification without extensive additional information requests. Contractors submitting bare calculations without documentation create the adequacy failures that delay audit processes even when rate calculations might be accurate.

Ten Essential Steps for Successful Incurred Cost Submissions

Step 1: Establish Year-Round Compliant Cost Accumulation

Implement accounting systems maintaining compliant cost accumulation throughout the fiscal year rather than attempting retrospective reconstruction for ICS preparation. Configure chart of accounts with adequate cost segregation between direct and indirect costs, separate general ledger accounts for each indirect pool, and dedicated accounts for unallowable costs excluded from government contract billing. DCAA timekeeping requirements apply year-round, with daily time recording, proper charge codes, and supervisor approval supporting the labor distribution underlying your indirect rate calculations.

Conduct monthly indirect rate calculations using the same methodology you’ll apply in year-end ICS submissions, ensuring cost accumulation, pool definitions, and allocation bases remain consistent throughout the year. Monthly discipline identifies potential issues early when correction remains feasible, rather than discovering problems during year-end closing when options become limited and time pressure intensifies.

Step 2: Maintain Systematic Unallowable Cost Identification Throughout the Year

Deploy procedures identifying unallowable costs at initial recording including accounts payable review flagging potentially unallowable expenses, expense report procedures requiring business purpose documentation supporting allowability, and management review approving questionable cost treatment. Create dedicated general ledger accounts for each major unallowable cost category enabling systematic exclusion from indirect pools without requiring year-end analysis reconstructing cost classifications.

Conduct quarterly unallowable cost reviews examining expense accounts for items requiring exclusion, documenting allowability determinations, and adjusting indirect rate projections reflecting unallowable cost impacts. This quarterly discipline ensures year-end ICS preparation involves compiling existing unallowable cost documentation rather than performing initial identification under deadline pressure.

Step 3: Prepare Detailed Submission Schedule Package Using DCAA Templates

Download current DCAA ICS submission templates from official sources ensuring you use current formats reflecting latest adequacy requirements. DCAA periodically updates schedule formats and requirements, with outdated templates creating adequacy problems regardless of calculation accuracy. Organize submission following prescribed schedule sequence facilitating DCAA review, with comprehensive table of contents, schedule cross-references, and explanatory notes supporting complex calculations or unusual items.

Complete all required schedules even when certain schedules may not apply to your business, noting “not applicable” with brief explanations rather than omitting schedules entirely. Schedule omissions trigger adequacy questions even when omitted schedules wouldn’t contain material information, with complete packages demonstrating submission thoroughness that partial packages cannot convey.

Step 4: Develop Comprehensive General Ledger to ICS Reconciliations

Create detailed reconciliations connecting each ICS schedule to specific general ledger accounts, trial balance line items, or audited financial statement amounts. Document the reconciliation methodology explaining how general ledger detail maps to ICS schedules, what adjustments bridge differences, and why adjustments are necessary and appropriate. These reconciliations provide the audit trail DCAA needs to verify submission accuracy without extensive additional documentation requests.

Prepare allocation base reconciliations demonstrating how direct cost bases used for indirect rate calculations tie to payroll summaries, labor distribution reports, and general ledger labor accounts. Document any adjustments reducing allocation bases for unallowable direct costs, IR&D, or other required exclusions, with supporting calculations proving adjustment accuracy and completeness.

Step 5: Compile Required Supporting Documentation Exhibits

Assemble comprehensive supporting documentation including: general ledger trial balance for submission period, audited financial statements when available, payroll summaries supporting labor cost assertions, organizational charts showing company structure, contract listings identifying all government contracts, facilities capital cost of money calculations when applicable, and executive compensation documentation supporting allowability. Organize exhibits logically with clear references to submission schedules they support, enabling DCAA reviewers to locate supporting information efficiently.

Develop explanatory memoranda for unusual items, significant cost changes from prior years, accounting policy modifications, or other matters requiring additional context beyond schedule numbers. These explanations demonstrate submission thoroughness while proactively addressing questions DCAA might otherwise raise during adequacy review.

Step 6: Conduct Internal Pre-Submission Adequacy Review

Perform comprehensive internal review using DCAA’s adequacy checklist verifying all required schedules are included, calculations are accurate, reconciliations are complete, and supporting documentation is adequate. Assign reviewers independent of submission preparation providing fresh perspective identifying issues preparers might overlook through familiarity. Document review findings, implement corrections, and maintain review records demonstrating quality control procedures supporting submission accuracy.

Engage external consultants or advisors to conduct mock adequacy reviews examining submissions against DCAA standards, identifying potential deficiencies, and recommending corrections before official submission. External review costs far less than DCAA rejections requiring resubmission, delayed audits, and prolonged billing reserve accumulation.

Step 7: Submit Through Proper Electronic Channels by Deadline

Register for WAWF system access well before submission deadline, ensuring technical capability to navigate electronic submission requirements without last-minute complications. Follow DCAA’s electronic submission procedures exactly including proper file formats (typically PDF), required file naming conventions, and complete submission packages uploaded together rather than piecemeal additions creating version confusion.

Submit at least two weeks before six-month deadline providing buffer for technical problems, system issues, or last-minute discoveries requiring correction. Late submissions violate contract terms while creating negative impressions affecting DCAA’s approach to your audit even after delayed submissions are eventually accepted.

Step 8: Maintain Responsive Communication During DCAA Adequacy Review

Monitor submission status through WAWF tracking and DCAA communication, responding promptly to adequacy questions or documentation requests. DCAA typically conducts initial adequacy review within thirty days after submission, identifying deficiencies requiring correction before audit scheduling. Rapid response to adequacy issues demonstrates contractor cooperation and professionalism while preventing unnecessary delays in audit scheduling.

Provide clear, complete responses to adequacy questions with supporting documentation, explanatory memoranda, and corrected schedules as needed. Incomplete or evasive responses to adequacy questions prolong review periods while creating auditor skepticism about submission reliability and contractor cooperation.

Step 9: Prepare Comprehensive Audit Support Documentation

Organize detailed audit support files anticipating documentation DCAA will request during rate audits including: detailed general ledger transaction listings by account, vendor invoices supporting significant expenses, payroll registers supporting labor costs, timesheets supporting labor distribution, contract files with cost accumulation details, unallowable cost supporting analysis, and indirect rate calculation workpapers. Systematic organization enables efficient audit response while demonstrating accounting system adequacy through readily available supporting records.

Develop audit response procedures assigning responsibilities for documentation gathering, establishing response timelines ensuring prompt delivery, and implementing quality review preventing submission of incomplete or inaccurate information. Efficient audit support reduces audit duration while building positive DCAA relationships supporting future interactions.

Step 10: Document Lessons Learned and Implement Process Improvements

Conduct post-submission reviews evaluating ICS preparation process effectiveness, identifying challenges encountered, documenting solutions implemented, and capturing lessons learned for future submissions. Create written procedures documenting your ICS preparation approach, schedule preparation methodology, reconciliation techniques, and review processes, establishing institutional knowledge supporting consistent submissions despite potential personnel changes.

Implement process improvements addressing difficulties encountered during preparation including accounting system enhancements enabling easier cost segregation, improved unallowable cost identification procedures, enhanced documentation practices, or earlier preparation timelines. Continuous improvement transforms ICS preparation from annual crisis into systematic business process supporting compliance and efficient operations.

The Investment in Compliant ICS Preparation

Implementing systematic ICS preparation procedures costs between $15,000 and $55,000 annually for small to mid-sized contractors depending on submission complexity, accounting system adequacy, and internal capability. This includes preparation time, external review, consultant support, and system improvements. However, these costs represent necessary compliance investments enabling contract performance and cash flow rather than discretionary expenses subject to deferral.

Let me show you the value: contractors with excellent ICS processes submit adequate proposals by deadline enabling timely DCAA audits, minimize questioned costs through thorough unallowable cost identification and comprehensive documentation, and maintain positive cash flow through prompt audit completion and billing reserve release. They avoid the extended audit cycles that result from inadequate submissions, prevention of billing reserve accumulation exceeding $500,000 or more, and reputation damage from perceived non-compliance affecting contract awards and customer relationships.

Contractors with poor ICS processes face submission rejection requiring rework while audit scheduling delays accumulate, experience cash flow constraints from billing reserves growing during extended audit periods, and incur crisis consulting costs implementing rushed corrections exceeding systematic preparation investments. They suffer relationship damage when customers view late or inadequate submissions as operational deficiency indicators affecting contract award decisions and performance evaluations.

Understanding ICS Requirements Across Contract Types and Agencies

FAR 52.216-7 incurred cost submission requirements apply to cost-reimbursement contracts across all federal agencies including Department of Defense, NASA, Department of Energy, and civilian agencies. Your submission obligations remain consistent regardless of customer agency, with DCAA conducting audits for most defense contracts while other audit agencies handle civilian work using similar standards.

Contractors holding multiple contracts with different fiscal year-end dates may face multiple submission deadlines requiring separate ICS packages for different accounting periods. Contractors with forward pricing rate agreements or advance agreements may have modified submission requirements, but fundamental obligation to submit final indirect cost proposals supporting actual rate determination remains consistent across contract types and customer agencies.

Your Path to ICS Success

The incurred cost submission landscape rewards contractors who maintain year-round accounting discipline rather than treating ICS as annual crisis requiring heroic effort. DCAA evaluates submissions against clear adequacy standards consistently applied, with success depending on systematic preparation and comprehensive documentation rather than relationships or negotiation.

For contractors seeking ICS compliance support, Hour Timesheet provides labor tracking foundation supporting accurate indirect rate calculations through daily timesheet discipline, proper charge code application, and comprehensive labor distribution documentation. Our systems integrate with accounting platforms enabling the cost accumulation accuracy that adequate ICS submissions require.

Your cost-reimbursement contracts deserve the accounting infrastructure supporting compliant submissions, timely audits, and healthy cash flow. Build ICS processes ensuring annual compliance becomes systematic business practice rather than annual emergency.

Additional Resources

Related Hour Timesheet Articles:

- DCAA Compliance Requirements for Contractors

- DCAA Compliance Explained

- DCAA Timekeeping Requirements

Official Regulatory References:

- FAR 52.216-7 – Allowable Cost and Payment

- FAR 42.705-1 – Contracting Officer Determination Procedure

- Cost Accounting Standards 406 – Cost Accounting Period

- DCAA ICE Submission Guidance

- DCAA Contract Audit Manual

- Defense Contract Audit Agency